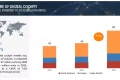

The in-vehicle infotainment market is projected to grow from USD 18.8 billion in 2023 to USD 31.4 billion by 2028, at a CAGR of 10.9%. Government mandates on telematics and e-call services, the emergence of various technologies such as 5G and AI, and ADAS and other autonomous solutions are expected to offer promising growth opportunities in the In-vehicle infotainment market.

Based on Region, Asia Pacific holds the largest share of the in-vehicle infotainment market during the forecast period. It witnessed higher growth in vehicle production than Europe and North America due to the availability of labor at lower wages, reduced production costs, lenient vehicle safety norms, and government initiatives for FDIs in the region. Vehicle production is mostly driven by countries such as China, South Korea, India, and Japan, which contribute ~88% of the total production of vehicles, and these countries within the region contributed ~60% of the global vehicle production in 2023. Thus, increasing vehicle production, along with changing consumer preferences and growing per capita income of the middle-class population, is driving the vehicle demand and encouraging automotive OEMs to increase production capacity and offer infotainment systems in lower-range cars as well.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=538

Growing consumer focus on passenger safety and the availability of entertainment services such as music, video streaming, and navigation features are major factors driving the in-vehicle infotainment market in developed and developing countries. This demand is primarily driving the front-row infotainment system demand globally.

Additionally, growing luxury vehicle sales and demand for screens for rear passengers to offer a more personalized experience and comfort are factors expected to fuel the rear-row in-vehicle infotainment system market during the forecast period. The emergence of 5G is also expected to contribute to the development of the in-vehicle infotainment industry. BMW iX, BMW Group became the first premium manufacturer to integrate the 5G mobile radio standard into a globally available production vehicle, and Vodafone is offering the first 5G mobile radio contract to BMW Group for such vehicles. Thus, considering the abovementioned factors, the in-vehicle infotainment system market is expected to grow significantly in the future.

By form type, the embedded segment is estimated to account for the largest market share in 2023 followed by the integrated segment which is estimated to be the second-largest in the same year. Regulatory mandates of Europe is primarily driving the growing demand of embedded technology, which is mandated in all new automobile models in member states as part of the European ecalll system, are mostly to blame for the proliferation of embedded technology. While the integrated form type is becoming more and more popular in Asia Pacific and RoW, the embedded form type is more common in Europe and North America. The cost-sensitive character of the areas (Asia Pacific and ROW), which choose integrated connectivity because it is more cost-effective than the embedded version, is the main motivator for this development. Globally, the integrated form type market is anticipated to develop at the highest CAGR due to its rapid acceptance in the aforementioned areas. Currently, Linux OS dominates the operating system market for in-car infotainment systems. However, because Android Automotive OS is an open-source platform, using it is free, and installing it costs less than installing most other operating systems. It now offers access to a number of services that are already used by millions of people worldwide and are predicted to expand at the fastest rate. within the anticipated term in the OS sector. Additionally, several automakers and suppliers are developing and promoting Android Automotive as for instance, Google’s automotive operating system, Android Automotive, has always been quite specialized, and only a few well-known vehicles, such as the Polestar 2, have utilized it. But as Android Automotive gains popularity, several of the top automakers are beginning to integrate Google’s operating system into their whole product lines. This system is something General Motors is rolling out to the majority of its portfolio shortly. The Hummer EV1 is powered by the same fundamental technology, and given how much parts sharing there is at GM, expect to see this system in Chevys, GMCs, Cadillacs, and Buicks. Having joined the Android Automotive ecosystem, Ford and Honda. Hence, Android Automotive OS is expected to emerge as the key OS for in-vehicle infotainment companies and register the highest growth rate of 34.4% during the forecast period.

The infotainment market for electric vehicles is growing at a significant rate over ICE cars. The introduced stringent emission regulations around the world, unstable oil prices, and shifting focus toward an environment-friendly ecosystem have fueled the demand for electric vehicles globally. Further, the penetration of advanced and connected technologies in EVs is higher, and demand for luxury and premium electric cars is on the rise. Luxury brands such as Mercedes-Benz, Tesla, and Audi are gaining their market share in luxury EV sales and are adding other luxury EV models to their product lineups. Multiple OEMs have announced to launch several EV models in the coming years. Growing electric vehicle sales, including premium vehicles, would consequently push the demand for in-vehicle infotainment in this segment.

Based on the retrofit market by vehicle type, the passenger car leads the market during the forecast period. Along with the increase in vehicle production at the global level, growing technological advancements, the introduction of sophisticated systems, improved connectivity infrastructure (4G/5G), rising disposable income, and changing preferences have shifted consumer focus on retrofitting of infotainment systems in newly sold cars. Lower to mid-range cars hold the dominant share in vehicle production, especially in developing countries of Asia Pacific and RoW, and most of these cars are not offered with infotainment systems or are installed with normal systems without touchscreen and other functionalities. On the other side, OEMs have also started offering embedded devices in lower-end cars from mid-range trims to sustain the competition, and the trend is expected to remain the same in the future as well. All these factors would keep the demand for retrofitted infotainment systems in the coming years.

The in-vehicle Infotainment market is consolidated. Harman International, Panasonic Corporation, Alps Alpine Co Ltd, Robert Bosch GmbH, and Continental AG are the top players in the in-vehicle Infotainment market. These players are based in North America, Europe, and Asia Pacific. Players adopted strategies such as collaborations, joint ventures, partnerships, and agreements to strengthen their position in the in-vehicle Infotainment market. These strategies accounted for a considerable share of all the growth strategies followed by companies in the market.

Key Market Players:

The in-vehicle Infotainment companies are Harman International (US), Panasonic Corporation (Japan), Alps Alpine Co Ltd (Japan), Robert Bosch Gmbh (Germany), and Continental AG (Germany). These companies adopted several strategies to gain traction in this market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=538