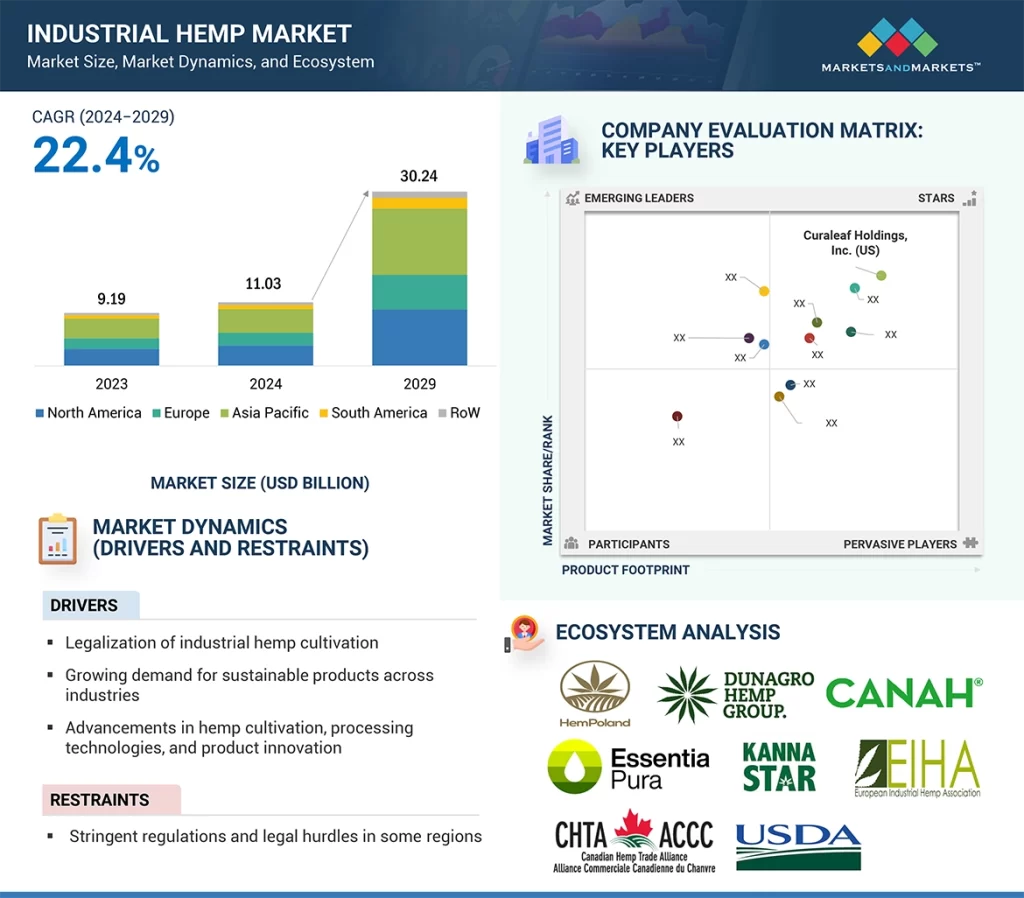

The global industrial hemp market is valued at USD 11.03 billion in 2024 and is projected to reach USD 30.24 billion by 2029, growing at a compound annual growth rate (CAGR) of 22.4% from 2024 to 2029. Increased investments in research and development are fuelling the market, unlocking new applications and improving product quality. Additionally, growing interest in hemp as a rotational crop among farmers is contributing to its adoption due to its positive impact on soil health and its role in supporting sustainable agriculture. Hemp’s potential as a source of biodegradable and renewable raw materials for industries like packaging and automotive is also boosting demand. Strategic partnerships among key market players and advancements in extraction technologies are further enhancing hemp’s versatility and driving innovation.

Industrial Hemp Market Drivers: Legalization of Industrial Hemp Cultivation

The legalization of industrial hemp farming has played a pivotal role in driving market growth, particularly in regions such as the US, Europe, and other countries. The 2014 US Farm Bill differentiated hemp from marijuana by setting the THC threshold below 0.3%, although its cultivation was initially restricted to research purposes. The 2018 Farm Bill eased these restrictions and established the Domestic Hemp Production Program, allowing hemp cultivation and commercialization. This change has empowered farmers to incorporate hemp into sustainable farming practices, providing eco-friendly alternatives to plastics and other materials. Similarly, countries in the European Union, including France, Poland, and Romania, have introduced financial incentives for hemp farming as part of their CAP Strategic Plans. In India, industrial hemp farming is now legalized in Uttarakhand, with standard hemp seeds approved by the Food Safety and Standards Authority of India, boosting the industry. Most recently, Germany passed draft legislation in 2024 to legalize industrial hemp cultivation, further supporting market growth.

Textile Segment Dominates the Industrial Hemp Market Share

The textile sector is expected to maintain the largest market share due to the superior qualities of hemp fibers, which offer strength, breathability, and environmental sustainability. Hemp is increasingly used in producing sustainable textiles, including garments, upholstery, and home furnishings. The demand for eco-friendly materials is driving manufacturers to adopt hemp, as it requires fewer resources—such as water and pesticides—compared to traditional crops like cotton. Furthermore, initiatives like Hemp4Circularity, supported by the European Union with a USD 4.1 million grant, are further enhancing hemp’s role in sustainable textiles. This project involves collaborations across Belgium, the Netherlands, and Germany to establish a local long-fiber hemp textile industry, promoting a circular economy in Europe. In 2022, France allocated 21,700 hectares for hemp, with 10% dedicated to textiles, while the EU designated 55,000 hectares for hemp farming, highlighting the growing importance of hemp in sustainable textile production.

Asia Pacific to Experience Highest Growth Rate

The Asia-Pacific region is expected to witness the highest CAGR in the industrial hemp market due to growing adoption across sectors such as textiles, bioplastics, and construction. The region’s industrialization, combined with increasing awareness of material sustainability, is driving demand for hemp-based products. Countries like China and India are capitalizing on their vast agricultural lands and low production costs, becoming major producers and exporters of industrial hemp. The expansion of textile and manufacturing industries in these countries further supports the integration of hemp in a sustainable manner. In addition, supportive regulations in countries like Australia, India, and Thailand are fostering the cultivation and processing of hemp. Technological advancements in extraction and processing are improving hemp quality and enabling it to meet global demand, while its eco-friendly properties, including biodegradability and low carbon footprint, align with efforts to reduce pollution in the region and promote circular economies.

Leading Industrial Hemp Manufacturers

Key players in the industrial hemp market include Curaleaf Holdings, Inc. (US), Green Thumb Industries (US), Canopy Growth Corporation (Canada), Aurora Cannabis Inc. (Canada), The Cronos Group (Canada), Ecofibre Ltd. (Australia), HempFlax Group B.V. (Netherlands), Dun Agro Hemp Group (Netherlands), Fresh Hemp Foods Ltd. (Canada), GenCanna (US), Konoplex Group (Russia), Canah International (Netherlands), MH Medical Hemp GmbH (Germany), Liaoning Qiaopai Biotech Co., Ltd. (China), and IND HEMP (US). These companies are at the forefront of the industry, driving innovation and growth in the global industrial hemp market.