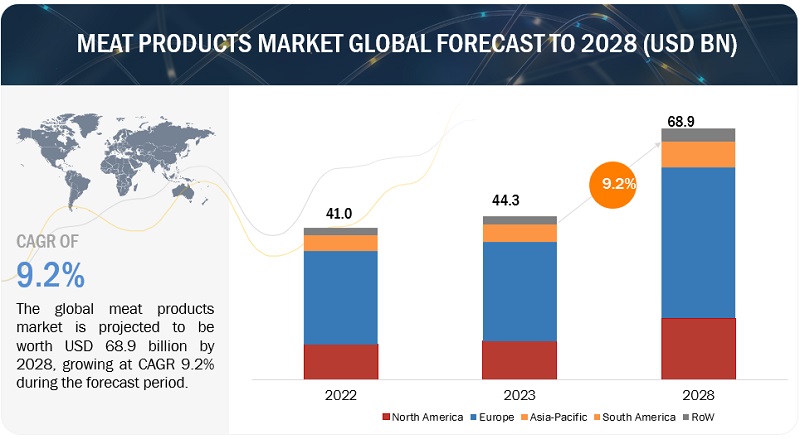

According to a research report “Meat Products Market by Animal (Beef, Pork, Poultry), Type (Processed, Frozen, Canned/Preserved, Chilled, Fresh), Distribution Channel (Retail, Food Service, E-Commerce), Nature, Packaging, and Region – Global Forecast to 2028″ published by MarketsandMarkets, the global meat products market, valued at USD 44.3 billion in 2023, showcases a remarkable growth projection, anticipated to escalate to USD 68.9 billion by 2028, indicating a robust compound annual growth rate (CAGR) of 9.2% during the forecast period. The consumption of poultry meat has increased across nearly all countries and regions. Consumers are drawn to poultry for its affordability, product consistency, adaptability, and higher protein/lower fat content. On a per capita basis, the substantial growth rates in poultry consumption underscore its significant contribution to the national diets of several densely populated developing countries. These countries include China, India, Indonesia, Malaysia, Pakistan, Peru (anticipated to surpass the United States as the second-largest per capita consumer), the Philippines, and Vietnam.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=53140407

The food service segment in the meat products market is poised for remarkable growth with the highest CAGR in the upcoming forecast period.

Marketing and menu promotion in the context of restaurants involve strategic efforts to attract customers, create brand awareness, and drive sales of specific menu items for meat-based dishes. the increasing demand for meat in restaurants is influenced by a combination of factors such as culinary innovation, convenience, social experiences, and changing consumer preferences. The restaurant industry continues to adapt to evolving trends, contributing to the sustained and growing popularity of meat-based offerings. Various food service types such as restaurants, takeaways, caterers cater to a diverse range of culinary preferences, offering various meat-based dishes to satisfy different tastes and cultural preferences. This diversity attracts customers seeking a broad selection of meat options. The convenience of dining out is a significant factor contributing to the demand for meat in restaurants. Consumers often prefer the ease of having professionally prepared meat dishes without the need for cooking at home.

The frozen segment within the meat products market emerged as a pivotal force in 2022, steering the market’s momentum.

The increasing popularity of frozen meat in the meat products market reflects the changing preferences and lifestyle needs of consumers. In an era where busy schedules are the norm, consumers prioritize convenience and time efficiency. Frozen meat products, which include a variety of processed options, provide a quick and uncomplicated meal solution that requires minimal preparation. The flash-freezing method not only ensures convenience but also extends the shelf life of the products while preserving their nutritional content. This aligns with the growing emphasis on food safety and quality, positioning frozen meat as a reliable choice for consumers. Additionally, the globalized nature of cuisine and the desire for diverse culinary experiences have led to a demand for a broader range of meats, a demand readily met by frozen options. Advances in freezing technologies, such as Individual Quick Freezing (IQF) and cryogenic freezing, significantly contribute to enhancing the overall quality of frozen meat products. The increasing preference for frozen meat is reshaping the dynamics of the meat products market, resulting in market expansion, heightened competition, and greater global market penetration. Manufacturers and retailers are adapting with creativity and strategic marketing initiatives, shaping a dynamic and competitive landscape within the industry. As the momentum of the frozen meat segment continues, it reveals promising opportunities for both consumers and industry stakeholders, influencing the future trajectory of the meat market.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=53140407

The US is poised to maintain its dominant position within the North American meat products market throughout the forecast period.

In 2022, the United States exhibited higher per capita consumption and per capita expenditure on meat compared to global and regional levels. The predominant category was chilled raw packaged meat-processed, followed by fresh meat (counter), chilled raw packaged meat – whole cuts, frozen meat, cooked meats – counter, cooked meats – packaged, and ambient meat. Among the leading cities in the US meat sector, fresh meat (counter) led in volume terms in 2020. Meat consumption was notably higher among males than females in the US. Hypermarkets & supermarkets emerged as the largest distribution channel in the US meat sector in 2022, followed by food & drinks specialists and convenience stores. Rigid plastics emerged as the most utilized packaging material in the US meat sector, with flexible packaging and rigid metal following in usage.

Prominent industry players, including Cargill (US), Hormel Foods Corporation (US), Verde Farms (US), Lopez Foods, Inc (US) wield substantial influence in the meat products market. These entities boast robust manufacturing facilities and well-established distribution networks across pivotal regions such as North America, Europe, South America, and the Asia Pacific, ensuring a widespread presence and accessibility of their products.

Get 10% Free Customization on this Report:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=53140407