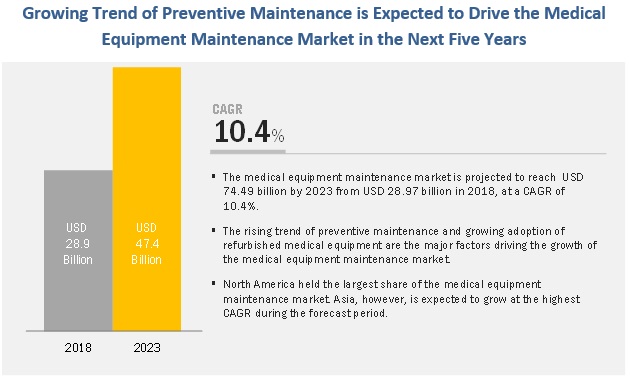

The medical equipment maintenance market is expected to reach USD 47.4 billion by 2023 from USD 28.9 billion in 2018, at a CAGR of 10.4% during the forecast period.

The market is witnessing growth due to factors such as growth in associated equipment markets, rising focus on preventive medical equipment maintenance, adoption of innovative funding mechanisms, and increasing purchase of refurbished medical equipment, On the other hand, high initial costs and significant maintenance expenditure may hinder the growth of this market in the coming years.

Download FREE Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=69695102

Innovation and offering value-added services will help medical equipment manufacturers gain the advantage in the highly competitive services market. To achieve this, medical equipment manufacturers are implementing Internet of Things (IoT) solutions into their sales, customer services, and product support strategies.

Based on device type, the market is segmented into imaging equipment, endoscopic devices, surgical instruments, electromedical equipment, and other medical equipment. In 2018, imaging equipment is expected to grow at the highest CAGR during the forecast period. The high growth of this market segment is attributed to the high demand for maintenance services for imaging equipment, due to high replacement costs and the need for ensuring maximum equipment uptime.

On the basis of region, the market is segmented into North America, Europe, Asia, and the Rest of the World (RoW). Asia is expected to grow at the highest CAGR during the forecast period. Factors such as the large installation base of medical equipment, significant presence of OEMs, and the growing medical technology market are supporting the growth of the medical equipment maintenance market in Asia.

The medical equipment maintenance and services sector was initially dominated by OEMs. However, OEMs typically charge more than third-party vendors do and often take longer for maintenance, resulting in higher associated costs as well as downtime. This situation, especially given the backdrop of continuing austerity measures and the need for cost-curtailment in global healthcare systems, has led to the emergence of ISOs dedicated to solely providing maintenance services. With a strong team of experts, these organizations can cater to customers in situations where OEMs fail to offer satisfactory and time-efficient solutions. Moreover, ISOs offer services for multiple brands of medical devices, providing end users with a central, independent management platform for uniform service delivery across all asset groups, while reducing maintenance costs. Considering their advantages as compared to OEMs, the preference for ISOs has increased among end users. The opportunities presented in the ISOs market is expected to draw a number of companies to this sector in the coming years.