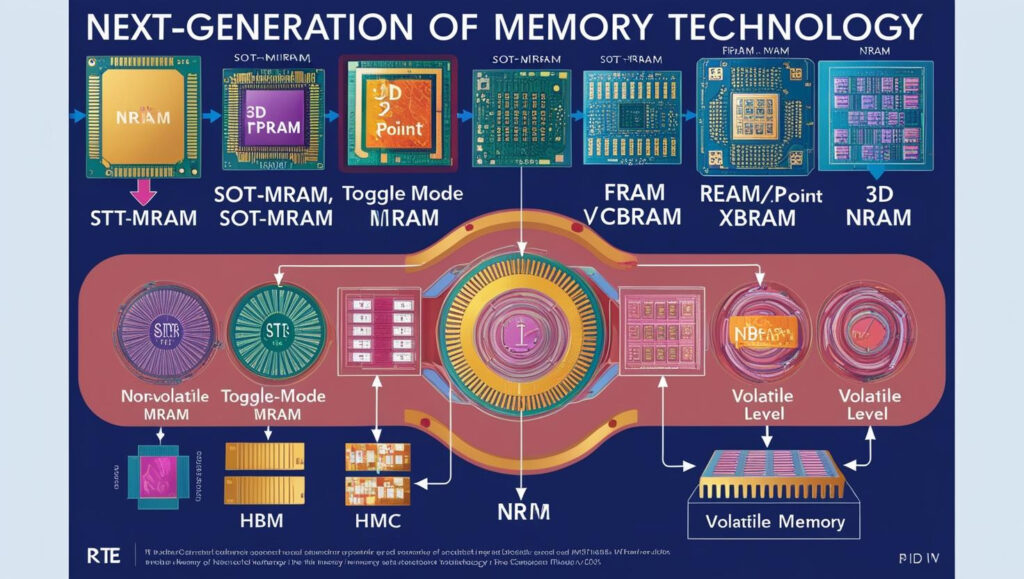

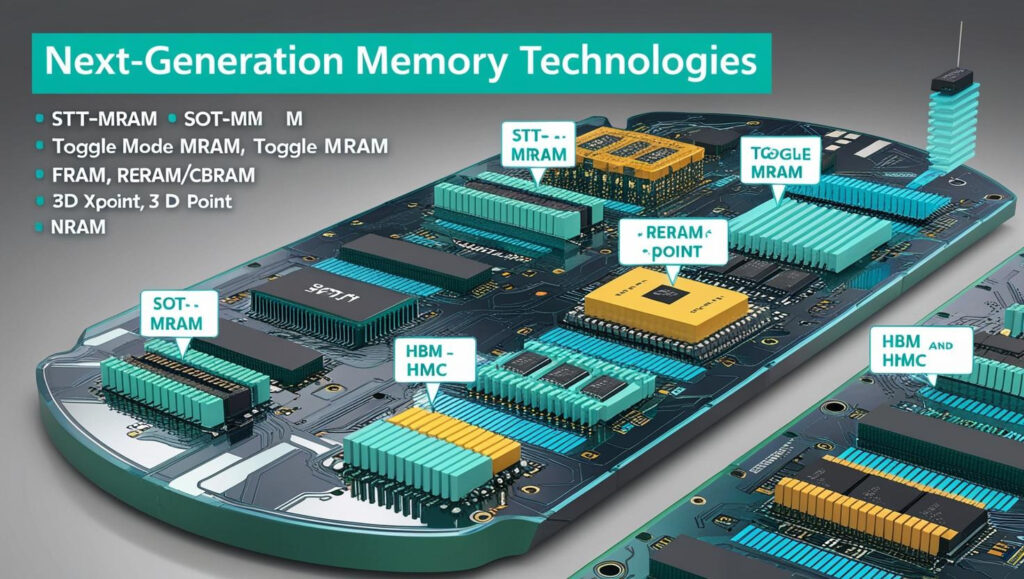

The growing need for high-performance computing, artificial intelligence (AI), and edge computing is driving demand for next-generation memory (NGM) technologies. Traditional memory solutions like DRAM and NAND flash are facing limitations in terms of speed, power efficiency, and endurance. This has led to the emergence of next-generation memory technologies, including Magnetoresistive RAM (MRAM), Resistive RAM (ReRAM), Phase-Change Memory (PCM), and 3D XPoint. These advanced memory solutions are designed to bridge the gap between volatile and non-volatile memory, offering high-speed performance with lower power consumption.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=632

As industries like automotive, data centers, consumer electronics, and healthcare continue to evolve, the demand for next-generation memory solutions is expected to rise exponentially in the coming years.

Market Size and Share

The next-generation memory market size was valued at USD 6.2 billion in 2023 and is estimated to reach USD 17.7 billion by 2028, growing at a CAGR of 23.2% between 2023 to 2028. This rapid growth is driven by increasing demand for high-speed, energy-efficient memory across multiple industries.

Segment-Wise Market Share

- By Technology:

- MRAM (Magnetoresistive RAM) holds a significant share due to its fast read/write speeds and high endurance, making it ideal for AI and IoT applications.

- ReRAM (Resistive RAM) is gaining traction due to its low power consumption and high-density storage, benefiting edge computing and IoT devices.

- 3D XPoint, developed by Intel and Micron, is positioned as an alternative to DRAM and NAND flash, offering persistent storage with low latency.

- By Application:

- Data centers account for the largest share, as cloud computing and AI workloads require faster, more efficient memory solutions.

- Automotive applications are witnessing a surge in demand due to the increasing integration of ADAS (Advanced Driver Assistance Systems) and autonomous driving technologies.

- Consumer electronics, including smartphones, wearables, and gaming consoles, are adopting next-generation memory to enhance processing power and user experience.

- By Region:

- North America dominates the market, with the presence of leading semiconductor companies like Intel, Micron, and Western Digital.

- Asia-Pacific is expected to experience the fastest growth, driven by expanding semiconductor manufacturing in China, South Korea, and Taiwan.

- Europe is also witnessing growth, supported by increased investments in automotive and industrial automation.

Future Opportunities in the Next-Generation Memory Market

1. Expansion of AI and Edge Computing

As AI and machine learning applications become more prevalent, ultra-fast memory solutions are required to process complex data in real-time. Next-generation memory technologies, such as MRAM and ReRAM, offer significant advantages in low latency and high-speed processing, making them ideal for AI-driven applications.

2. Growth in 5G and IoT Connectivity

The deployment of 5G networks is driving demand for high-performance, low-power memory solutions in IoT and edge computing devices. Next-generation memory will play a critical role in enabling real-time data processing in smart devices.

3. Rising Demand in the Automotive Industry

With the shift toward electric vehicles (EVs) and autonomous driving, automakers are investing in memory solutions that offer high durability and faster processing speeds. MRAM and STT-MRAM (Spin-Transfer Torque MRAM) are expected to gain traction as they provide better endurance and data integrity.

4. Increasing Investments in Data Centers

Tech giants like Google, Amazon, and Microsoft are expanding their cloud infrastructure, which demands faster, more reliable storage. Next-generation memory solutions will help improve energy efficiency and data transfer speeds in large-scale data centers.

5. Emerging Role in Quantum Computing

Quantum computing is set to revolutionize data processing, and next-generation memory technologies could play a vital role in high-speed storage solutions for these advanced systems.

Key Players in the Market

Several companies are leading the development and commercialization of next-generation memory technologies:

- Intel Corporation – Leading the market with Optane (3D XPoint) memory for data centers.

- Samsung Electronics – Investing heavily in MRAM, ReRAM, and FeRAM for next-gen applications.

- Micron Technology – Developing high-performance memory solutions for AI and cloud computing.

- Western Digital – Focused on next-generation storage solutions for data-intensive applications.

- SK Hynix – Investing in emerging memory technologies for consumer and industrial applications.

Challenges and Market Constraints

Despite the strong growth potential, the next-generation memory market faces some challenges:

- High production costs and complex manufacturing processes slow down mass adoption.

- Limited compatibility with existing computing architectures may hinder integration in legacy systems.

- Competition from traditional memory technologies like DRAM and NAND flash continues to pose a challenge.

The next-generation memory market is set to witness exponential growth, driven by advancements in AI, 5G, IoT, and autonomous vehicles. While challenges remain, ongoing investments in R&D and emerging applications will ensure sustained market expansion. Companies that invest in scalable, energy-efficient, and high-performance memory solutions will gain a competitive edge in the future of computing and data storage.