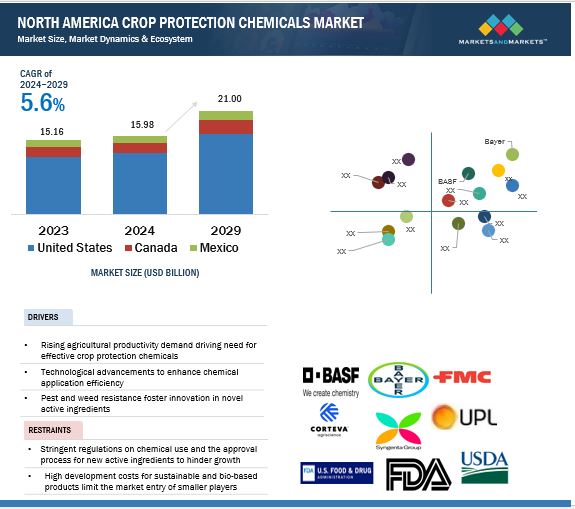

The North American crop protection chemicals market is projected to grow from USD 15.98 billion in 2024 to USD 21.0 billion by 2029, at a compound annual growth rate (CAGR) of 5.6%. As a leading agricultural exporter, North America is one of the largest consumers of crop protection chemicals, driven by large-scale farming operations, an efficient distribution network, and export-oriented production.

Key Market Drivers

North America’s dominance in the crop protection market is fueled by several factors:

- Abundant Resources: Fertile soil, ample water supply, and vast agricultural land.

- Advanced Infrastructure: Well-developed farming technology and mechanized operations.

- Entrepreneurial Farmers: Strong adoption of innovative and efficient farming practices.

However, sustainability concerns, rising labor costs, and the need for resource-efficient farming are increasing the demand for advanced crop protection solutions to improve productivity and yield.

Impact of Climate Change on Crop Protection

A 2022 study by North Carolina State University indicates that climate change is shifting pest distribution patterns. For example, the corn earworm (Helicoverpa zea) is expanding northward in the U.S., threatening key crops such as maize, cotton, soybeans, and vegetables. This trend is driving demand for pesticides and integrated pest management solutions.

Climate Change and Evolving Agricultural Needs

- Rising temperatures and changing precipitation patterns are intensifying pest infestations, increasing the need for insecticides and fungicides.

- Longer growing seasons for pests like corn rootworm and soybean aphids are leading to greater pesticide use.

- Elevated CO₂ levels are accelerating weed growth, boosting herbicide applications.

- Crop yield losses due to insect pressure are projected to rise by 10-25% per degree Celsius of warming.

- Extreme weather events (e.g., droughts, heavy rainfall) can reduce chemical efficacy, prompting the development of weather-resistant formulations.

Precision agriculture—which integrates climate data—enables farmers to optimize chemical use, reduce costs, and improve efficiency. Industry leaders such as Bayer and BASF are investing in climate-resilient pesticides and integrated pest management strategies to tackle these challenges.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=380

Herbicides Lead the Market

Herbicides are the largest segment in North America’s crop protection chemicals market, essential for controlling weeds in key crops such as corn, soybeans, and wheat. The widespread adoption of genetically modified (GM) herbicide-resistant crops allows for broad-spectrum herbicide applications with minimal crop damage, reducing labor costs by eliminating manual weeding.

Key Developments in Herbicides:

- Innovation in herbicide formulations is improving efficiency and reducing environmental impact.

- Regulatory and industry support continue to strengthen their market position.

- Bayer AG’s Roundup remains widely used due to its compatibility with GM crops.

- Corteva Agriscience is expanding its sustainable herbicide portfolio to address weed resistance issues.

Rising Demand in the Fruits and Vegetables Segment

The North American crop protection chemicals market serves a diverse range of crops, including corn, soybeans, wheat, rice, fruits, and vegetables. The fruits and vegetables segment is expected to experience significant growth due to:

- Increasing consumer demand for high-quality produce.

- Stricter crop quality and safety regulations.

- Intensive pest management needs requiring both chemical and bio-based solutions.

According to FAO Agricultural Production Statistics (2000–2022):

- Global fruit production increased by 63%.

- Vegetable production grew by 71%.

Given their high value, fruits and vegetables require extensive pest control measures, fueling demand for innovative crop protection solutions.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=380

The United States: Leading the North American Market

The U.S. is the largest market for crop protection chemicals in North America, benefiting from:

- Expansive farmland and high agricultural productivity.

- Widespread adoption of advanced farming techniques.

- Strong reliance on crop protection solutions to maximize yields.

Industry Innovations and Key Players

Concerns over food security and limited arable land are accelerating the development of next-generation crop protection products. Leading companies are investing heavily in research and development (R&D) to create eco-friendly and high-performance solutions.

Notable Industry Developments:

- FMC Corporation launched Ethos Elite LFR in 2024, an insecticide/biofungicide combining bifenthrin with proprietary biological strains for early-season pest and disease protection.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=380

Major Players in the North American Crop Protection Market

The key players in the North American market include BASF SE (Germany), Bayer AG (Germany), FMC Corporation (US), Syngenta Group (Switzerland), Corteva (US), UPL (India), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), Albaugh LLC (US), Koppert (Netherlands), Gowan Company (US), and American Vanguard Corporation (US), etc. Companies are focusing on product innovations, bio-based and eco-friendly solutions, and technology adoption for maintaining growth and competitiveness. Key players like Corteva, Bayer, and BASF are investing in R&D to develop crop-specific and environmentally sustainable pesticides.