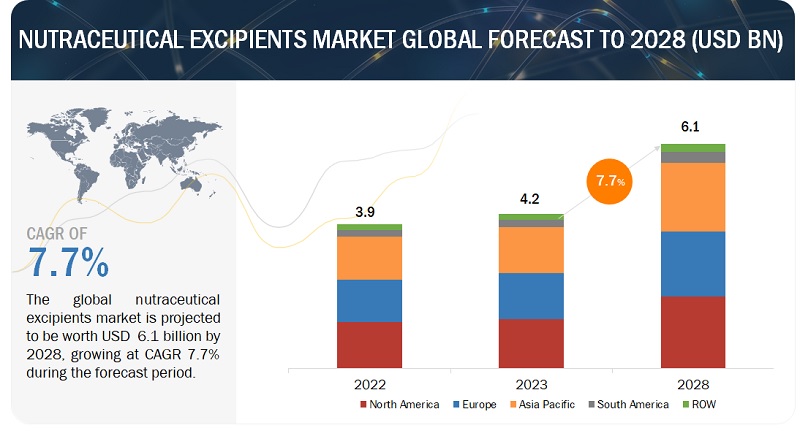

The nutraceutical excipients market size is projected to grow from USD 4.2 billion in 2023 to USD 6.1 billion by 2028, growing at a CAGR of 7.7% during the forecast period. Personalized nutrition plans and online sales are rapidly merging to transform the nutraceutical market. As individuals embrace tailored diets, the need for customized products with specific excipients, tailored delivery systems, and targeted nutrients soars. The flourishing retail market indicates a larger consumer base with increased disposable income and a heightened focus on health and wellness. Consequently, there is a surge in demand for nutraceutical products like functional foods and dietary supplements. This escalating demand is driving the necessity for specialized excipients utilized in formulating these products. According to the USDA, total retail food sales in the United States soared to USD 15.2 billion for the week ending May 1, 2022, compared to USD 12.7 billion for the same period in 2019, showcasing significant fluctuations across various categories.

Nutraceutical Excipients Market Growth Drivers:

- Increasing Demand for Functional Foods and Dietary Supplements: Consumers are increasingly turning to functional foods and dietary supplements to meet their nutritional needs and maintain overall health. This growing demand is driving the need for innovative formulations, thereby boosting the demand for nutraceutical excipients.

- Rising Investments in Research and Development: Manufacturers in the nutraceutical industry are increasingly investing in research and development activities to introduce new and improved products that cater to evolving consumer preferences and health trends. This focus on innovation is driving the demand for specialized excipients tailored to specific formulation requirements, thereby stimulating market growth.

- Growing Regulatory Support: Regulatory agencies are playing a pivotal role in shaping the nutraceutical industry by establishing guidelines and standards to ensure product safety, efficacy, and quality. The presence of clear regulatory frameworks fosters consumer confidence and encourages market players to invest in product development and expansion, consequently driving growth in the nutraceutical excipients market.

- Expansion of Distribution Channels: The nutraceutical market is witnessing an expansion of distribution channels, including online retailing, specialty stores, pharmacies, and supermarkets, providing manufacturers with greater access to consumers. This broader reach is expected to facilitate market penetration and drive demand for nutraceutical excipients to support the production of diverse product formulations.

Nutraceutical Excipients Market Opportunities: Emerging trend of high use of excipients with multifunctional properties among key players

The utilization of excipients possessing multifunctional properties presents a significant opportunity in the nutraceutical industry. By consolidating numerous functionalities within a single ingredient, these excipients streamline the formulation process, boosting operational efficiency and reducing the complexity of formulations. This consolidation not only decreases the number of required excipients but also curtails production costs. Moreover, their diverse capabilities, ranging from enhancing stability and solubility to controlling release and masking unwanted tastes or odors, enable the creation of top-tier nutraceutical products with optimized performance. Furthermore, the multifaceted benefits offered by these excipients align with sustainability goals, reducing waste and energy consumption while supporting clean label trends by enabling formulations with fewer, often natural, ingredients.

The Fillers & Diluents segment is expected to hold the second largest market share in the functionality segment of nutraceutical excipients market.

Fillers & diluents are integral for providing bulk to formulations and ensuring consistent dosages. Their primary role involves creating uniform tablet sizes, facilitating streamlined manufacturing processes, and ensuring even distribution of nutrients. Certain fillers & diluents are specially designed to aid in tablet or capsule disintegration and dissolution, ensuring efficient breakdown in the digestive system for optimal nutrient absorption. They also improve the flow characteristics of formulations, binding ingredients, reducing powder segregation, and enhancing compaction properties during production. Consequently, the fillers & diluents segment is anticipated to play a significant role in the functionality segment of nutraceutical excipients.

Make an inquiry to address your specific business needs. https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=247060367

North America will dominate the nutraceutical excipients market during the forecast period.

North America is expected to dominate the nutraceutical excipients market during the forecast period from 2023 to 2028 due to several factors. North America’s mature nutraceutical market, complemented by its robust pharmaceutical and nutraceutical industries, forms a strong platform for excipient innovation. Renowned for pioneering advancements, the region continually invests in R&D, crafting cutting-edge excipients with superior functionality, improved bioavailability, and precise nutrient delivery. This ongoing commitment to innovation positions North America at the forefront, alluring global industry players. The region boasts a well-established retail infrastructure, offering easy access to nutraceuticals through diverse distribution channels like online platforms, specialty outlets, and conventional supermarkets, fostering nutraceutical excipients market expansion.

Top Companies in the Nutraceutical Excipients Market

- International Flavors & Fragrances Inc (US)

- Kerry Group plc (Ireland)

- Ingredion (US)

- Sensient Technologies Corporation (US)

- Associated British Foods plc (UK)

- BASF SE (Germany)

- Roquette Frères (France)

- MEGGLE GmbH & Co. KG (Germany)

- Cargill, Incorporated (US)

- Ashland (US)