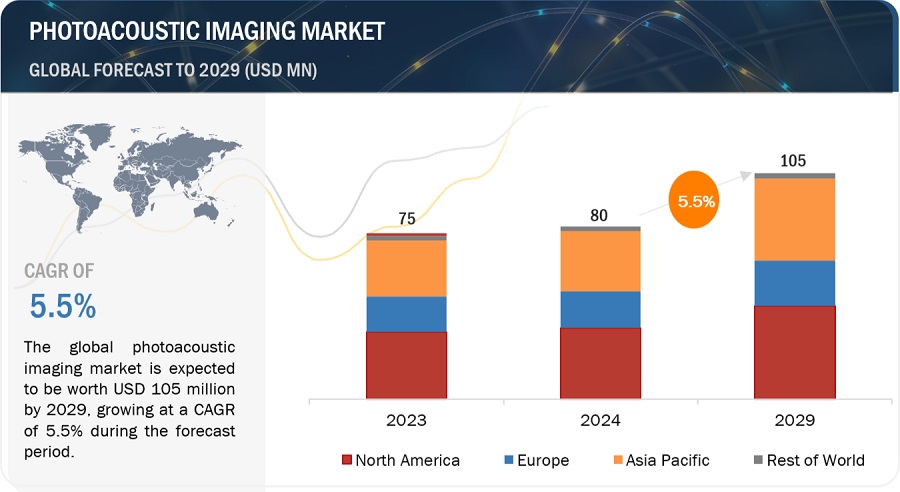

The global Photoacoustic Imaging Market is projected to grow from $80 million in 2024 to $105 million by 2029, with a CAGR of 5.5%. This detailed research covers industry trends, pricing analysis, patent reviews, conference insights, key stakeholders, and market purchasing behavior. The surge in investments and strategic partnerships in imaging systems drives market growth, with emerging markets poised to offer new opportunities.

The market is experiencing substantial growth fueled by rising investments, both direct and indirect, in imaging systems, alongside strategic partnerships aimed at advancing imaging technology. Furthermore, the increasing number of conferences and symposia dedicated to imaging technologies is contributing to this growth. Looking forward, emerging markets are expected to offer promising opportunities for industry players over the next five years.

Competitive Landscape and Key Players

The photoacoustic imaging market is characterized by a competitive landscape with various established and emerging players. Key stakeholders as of 2023 include Advantest Corporation, Cyberdyne, Inc., Fujifilm Corporation, IllumiSonics Inc., iThera Medical Gmbh, Kibero, Opotel LLC, TomoWave Laboratories, Vibronix, PhotoSound Technologies, and Seno Medical. These entities are instrumental in shaping market dynamics through innovation and strategic initiatives.

Photoacoustic Imaging Market: Market Dynamics

Driver: Increasing prevalence of cancer.

The increasing prevalence of cancer is emerging as a significant growth driver for the market. As cancer rates continue to rise globally, there is a growing need for advanced imaging technologies that can offer early detection, precise diagnosis, and monitoring of treatment effectiveness. Photoacoustic imaging’s ability to provide high-resolution, real-time images of tissue at various depths, including vascular and molecular information, positions it as a promising tool in the fight against cancer. This technology not only enhances oncological research but also supports personalized treatment strategies, thereby fueling its adoption in clinical settings and driving market expansion.

Restraint: High cost of the photoacoustic imaging system

Photoacoustic Computed Tomography (PACT) is a hybrid, noninvasive imaging modality crucial for functional and molecular imaging in biomedicine. It has rapidly gained importance due to its superiority over traditional optical imaging techniques. However, its clinical adoption is hindered by high development costs; typical commercial systems range from USD 200K to USD 900K. These costs primarily stem from the need for high-power pulsed lasers, sensitive ultrasound transducers, and complex signal processing units. The lasers used are advanced, tunable models producing short, precisely controlled pulses, costing between USD 15,000 to USD 25,000. These lasers demand expensive manufacturing, regular maintenance, and calibration for optimal performance. Similarly, ultrasound transducers must be exceptionally sensitive to detect the faint signals generated by the photoacoustic effect, often requiring custom designs, further increasing expenses.

Opportunity: Rising demand for personalized medicines.

Personalized medicine, which tailors’ medical treatment to the individual characteristics of each patient, is driving innovation and growth in various medical imaging technologies, including Photoacoustic imaging. This demand impacts the Photoacoustic imaging market through several key points: it enhances diagnostics by offering high-resolution imaging at molecular levels, ideal for identifying disease markers specific to individual patients, which aligns with the personalized medicine approach requiring precise diagnostic tools. Additionally, Photoacoustic imaging facilitates early detection of diseases by visualizing molecular and cellular changes, improving patient outcomes through timely and targeted interventions. Furthermore, its real-time imaging capabilities allow clinicians to monitor the effects of personalized therapies as they are administered, providing crucial feedback for promptly adjusting treatments to ensure optimal efficacy. As a non-invasive technique that does not use ionizing radiation, Photoacoustic imaging is also safer for repeated use.

By product, the imaging system segment accounted for the largest share of the photoacoustic imaging industry in 2023.

Based on product, the photoacoustic imaging market is segmented into imaging system, transducers, and software and accessories. In 2023, the imaging system segment accounted for the largest market share. Photoacoustic imaging has seen significant advancements recently, driving growth in its market. Innovations in laser and ultrasound technology have enhanced resolution and imaging depth, allowing for more precise and detailed images of biological tissues.

By technology, photoacoustic imaging segment accounted for the largest share of the photoacoustic imaging industry during the forecast period.

Photoacoustic imaging products type include photoacoustic imaging, photoacoustic microscopy, and photoacoustic tomography. In 2023, the photoacoustic imaging segment accounted for the largest market share. The demand for photoacoustic imaging in research is primarily fueled by the need for streamlined processes, strict regulations ensuring product quality and performance, and the growing number of research and development initiatives in the industry.

By type, pre-clinical segment of the photoacoustic imaging industry accounted for the largest share during the forecast period.

Photoacoustic imaging market segment include pre-clinical, and clinical research. In 2023, the pre-clinical segment accounted for the largest market share. The demand for photoacoustic preclinical research is primarily driven by the need for streamlined processes, stringent regulations ensuring product quality and performance, and the increasing number of research and development initiatives in the industry.

By application, the oncology segment of the photoacoustic imaging industry will register significant growth in the near future.

Based on application, the photoacoustic imaging market is broadly segmented into oncology, hematology, veterinary, and other applications. The oncology segment to register the highest growth from 2024 to 2029. In recent times, research has become pivotal in the advancement of pharmaceuticals, offering pathways for addressing a multitude of medical ailments such as cancer, rheumatoid arthritis, psoriasis, Crohn’s disease, and diabetes, among various others. As a result, the growing incidence of chronic illnesses, coupled with heightened research endeavors aimed at vaccine development, is driving the growth of this industry.

By end-users, the research institutes and academia segment of the photoacoustic imaging industry will register significant growth soon.

Based on end-users, the photoacoustic imaging market is broadly segmented into hospitals and imaging centers, and academic & research institutes. The academic & research institutes segment to register the highest growth from 2024 to 2029. Academic & research institutes are central to advancing photoacoustic imaging technologies by prioritizing improvements in imaging modalities to enhance efficiency and versatility. They also focus on elevating image quality through innovative algorithms and techniques to boost resolution and contrast, while exploring new applications across biomedical sciences ranging from oncology to neurology.

By region, North America is expected to be the largest market of the photoacoustic imaging industry during the forecast period .

North America, comprising the US and Canada, accounted for the largest share of the photoacoustic imaging market in 2023. The notable growth of the North American market can be largely attributed to the stringent FDA regulations governing product approval and safety, as well as the robust presence of hospitals and imaging centers. Additional factors contributing to the market expansion in North America include increased investment in imaging systems.

Recent Developments of Photoacoustic Imaging Industry

- In May 2022, FUJIFILM CORPORATION (Japan) (FUJIFILM VisualSonics, Inc ) has launched Vevo F2, ultrasound and photoacoustic imaging system that operates across an ultra-wide frequency range of 71 MHz to 1 MHz. This new system represents a breakthrough in ultra-high frequency ultrasound and photoacoustic imaging technologies.

- In November 2022, Seno Medical has announced the commercial launch of its Imagio Breast Imaging System, a new modality in breast imaging. The system will be introduced at the annual RSNA Scientific Assembly and Annual Meeting, taking place from November 27 to December 1 in Chicago.

- In June 2022, Seno Medical has announced the commercial launch of its Imagio Breast Imaging System, a new modality in breast imaging. The system will be introduced at the annual RSNA Scientific Assembly and Annual Meeting, taking place from November 27 to December 1 in Chicago.

Content source:

https://www.marketsandmarkets.com/PressReleases/photoacoustic-imaging.asp

https://www.marketsandmarkets.com/Market-Reports/photoacoustic-imaging-market-87132270.html