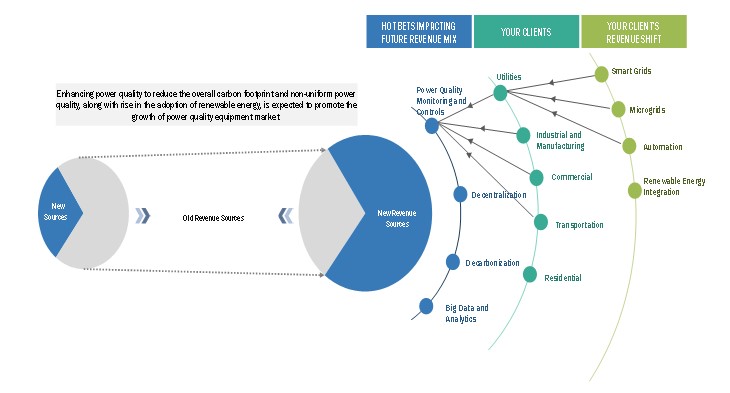

Power Quality Equipment Market New Revenue Pockets:

The global power quality equipment market is projected to reach USD 46.1 billion by 2026 from an estimated USD 32.4 billion in 2021, at a CAGR of 7.3% during the forecast period. Reducing overall carbon footprint from electrical devices by improving power quality and maximizing financial costs and energy savings are the key factors driving the growth of the power quality equipment market. The worldwide increase in adoption of smart grid technologies and the integration variable renewable energy with power grids are expected to offer profitable opportunities for the power quality equipment market during the forecast period.

Impact of COVID-19 on Power Quality Equipment Market:

COVID-19 has slowed the growth of the power quality equipment market, as countries were forced to implement lockdowns during the first half of 2020. Strict guidelines were issued by governments and local authorities, and all non-essential operations were halted. This adversely affected the power quality equipment market owing to the suspension of activities of end users.

In addition, production and supply chain delays were also witnessed during the second quarter which poised a challenge to the power quality equipment market, since end-user industries were still not operating at their full capacity.

Key Market Players:

Some of the key players are Siemens (Germany), ABB (Switzerland), Eaton (Ireland), Schneider Electric (France), and General Electric (US). The leading players are adopting various strategies to increase their share in the power quality equipment market.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=110225967

The power quality equipment market in Asia Pacific is projected to be the fastest growing market at during the forecast period. The market in this region has been studied for China, Japan, India, and the Rest of Asia Pacific (South Korea, Australia, Thailand, Vietnam, and Malaysia). The power quality equipment market in Asia Pacific is dominated by China and India. The surging demand for electricity and the growing requirement to increase renewable power generation capacity encourage utilities in these countries to invest in transmission and distribution infrastructures. Asia Pacific is expected to invest USD 9.8 billion in developing smart grid infrastructures from 2018 to 2027. In addition, the development of smart grids in countries such as China, Japan, South Korea, and India is supported by regulations that either encourage or mandate their development. The growth of the market in this country is driven by the increasing investments in transmission and distribution infrastructures and the growing adoption of renewable energy in China.

The power quality equipment market, by phase, is segmented into single phase and three phase. The three phase segment is projected to lead the power quality equipment market from 2020 to 2026. Three-phase power quality equipment are used in utilities, along with industrial and transportation sectors since three phase is commonly used by consumers globally

Based on equipment, the power quality equipment has been segmented into surge arresters, surge protection devices, harmonic filters, power conditioning units, power distribution units, uninterruptable power supplies, synchronous condensers, voltage regulators, digital static transfer switches, static VAR compensators, solid oxide fuel cells, isolation transformers, and power quality meters. The uninterruptable power supplies segment accounted for the largest share of power quality equipment market in 2020. These supplies provide stable and reliable power to critical safety-related loads such as emergency lights and medical equipment, reduce or avoid production losses, minimize or eliminate production damage, avoid product or facility damages, and reduce or avoid electricity-using equipment damages.

Ask FREE Sample Pages of the Report – https://www.marketsandmarkets.com/requestsampleNew.asp?id=110225967

Based on end user, the power quality equipment market has been segmented into industrial and manufacturing, commercial, utilities, transportation, and residential. The industrial and manufacturing segment is projected to hold the largest market size of the power quality equipment market from 2021 to 2026. The growth of this segment is driven by rise in demand for uninterrupted power supply to machines used in manufacturing and process industries as any interruption or breakdown can result in significant losses due to the loss of production time. Utilities are the key consumer of power quality equipment owing to the fact that the sheer size of electrical networks operated by utilities is larger than the industrial and transportation electric infrastructures.