The global precision diagnostics and medicine market, valued at US$132.46 billion in 2023, is forecasted to grow at a robust CAGR of 11.1%, reaching US$145.53 billion in 2024 and an impressive US$246.66 billion by 2029. Factors such as the growing integration of AI and ML to enhance precision diagnostics and medicine development supported by rising collaborations between pharmaceutical and diagnostics companies to improve precision healthcare and the rise in direct-to-consumer testing are driving the growth in the market. Moreover, expanding precision healthcare applications into other disease areas and the growing adoption of wearable devices to enhance precision healthcare offer growth opportunities to players in this market. Major players in this market are also expanding their geographic presence by establishing manufacturing and research facilities in emerging economies.

Download an Illustrative overview

DRIVER: Growing integration of artificial intelligence and machine learning

AI and ML technologies support the growth of the precision diagnostics and medicine market by enhancing the data analysis capabilities, for more accurate predictions and development of personalized treatment plans and optimized therapeutic strategies. Tools such as Stratipath Breast analyzes histopathology images using AI technology to predict the recurrence of breast cancer. Moreover, in 2024, researchers from the NIH developed an AI-based tool to match cancer drugs with patients based on the genetic profile of the patient’s tumor. This tool uses ML to predict the drug efficacy by analyzing individual cells in the patient’s tumor. Similarly, in October 2024, Ataraxis AI launched Ataraxis Breast, an AI-native prognostic/predictive test for breast cancer. These developments highlight a growing focus of pharmaceutical and diagnostics companies towards the integration of AI and ML to make precision healthcare more efficient, accurate, and accessible.

RESTRAINT: High Cost of Precision Healthcare

The high cost of precision healthcare is a significant restraint on the widespread adoption of precision therapies and diagnostics kits. The research and development cost required for the development of precision therapies is substantially more than traditional therapies as these require the use of genetic testing to determine specific biomarkers for the drug. Moreover, the collection of real-world and non-clinical data for evidence generation adds to the cost. Precision drugs such as Novartis AG’s Kymriah, a CAR-T therapy require extensive R&D investments which increase the cost of the drug making it unaffordable for patients. Moreover, the infrastructure required for genomic testing and data collection is another financial burden limiting the adoption of these therapies. According to an article published in 2023, precision medicine is likely to increase healthcare costs, especially in nations with privatized healthcare systems such as the US. The article highlights that the high cost of the drug would limit its adoption to patients with costly private firm-backed insurance plans increasing healthcare inequality.

OPPORTUNITY: Expanding Application Of Precision Healthcare

The players in the precision diagnostics and medicine market are exploring new growth opportunities by expanding the applications of precision medicines beyond oncology into other therapeutic areas such as autoimmune disorders and neurological diseases. Researcher are focusing their efforts on discovering biomarkers for various neurodegenerative such as Alzheimer’s and Parkinson’s diseases. For instance, in 2021, researchers found microRNA biomarkers linked to synaptic dysfunction associated with Alzheimer’s Disease. Moreover, in 2024, the Alzheimer’s Drug Discovery Foundation (ADDF) and the Journal of Prevention of Alzheimer’s Disease (JPAD) highlighted the role of biomarkers and precision medicines as potential therapies for AD supported by the success of Leqembi (lecanemab-irmb), a precision therapy developed by Eisai Co., Ltd. and Biogen, for the treatment of early AD. Additionally, major pharmaceutical companies are collaborating to develop advanced therapies and diagnostic tests for neurodegenerative and autoimmune diseases as highlighted by the 2024 collaboration between NImmune Biopharma and Biotherapeutics, Inc. to develop advanced biomarker-based precision drugs for inflammatory and autoimmune diseases. Similarly, in 2023, Bristol-Myers Squibb Company and Evotec expanded their collaborations to develop treatments for neurodegenerative diseases leveraging Evotec’s precision medicine platforms. These collaborations and developments support the growing focus of pharmaceutical companies on the development of precision medicine for other disease areas.

CHALLENGES: Big data management and integration issues

A major challenge in the precision diagnostics and medicine market is the management and integration of big data for the development of precision drugs and diagnostics kits. Precision healthcare requires analysis of large amounts of complex data such as genetic, clinical, and environmental information, to develop personalized treatments. However, the electronic health records (EHRs) used in hospitals and clinics often are not compatible with formats required for genetic data integration limiting the use of these records. There is a gap between data generation and its integration and as the amount of medical data from genomics, proteomics, and medical imaging grows the pressure on the current information technology infrastructure increases on the current information technology infrastructure as many informatics tools cannot handle vast datasets in real-time. Moreover, the medical records stored in EHRs often have missing data or inaccuracies reducing the effectiveness of these data in clinical decision making.

Global Precision Diagnostics and Medicine Market Ecosystem Analysis

The ecosystem for precision diagnostics and medicine offerings comprises major pharmaceutical and diagnostics companies offering precision therapies and diagnostics kits, regulatory authorities, and end users, such as hospitals and clinical laboratories. These stakeholders interact and collaborate to drive the advancements in precision healthcare.

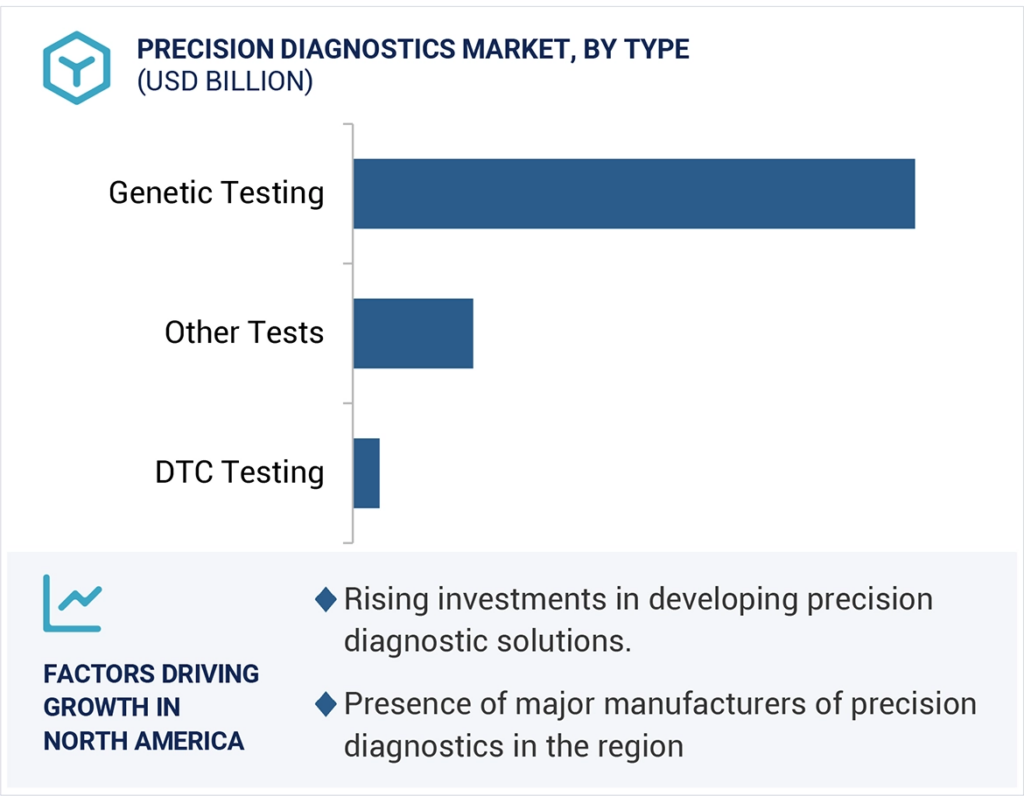

The genetic testing segment held the largest market share in the precision diagnostics market, by type, in 2023.

Based on the type, the precision diagnostics market is segmented into genetic testing, DTC testing, and other tests. The genetic testing segment held the largest market share of the precision diagnostics market by type in 2023. These tests are used to identify genetic variations in genes to diagnose, predict, or manage diseases. The large share of this segment is supported by the increasing research and investments to develop advanced genetic tests for various diseases.

The oncology segment led the precision medicine market, by indication in 2023.

Based on indications, the precision medicine market is segmented into oncology, rare diseases, infectious diseases, hematological disorders, and other indications. In 2023, the oncology segment accounted for the largest share of the precision medicine market by indication. This large share of this segment is supported by the strong emphasis of pharmaceutical companies on developing precision cancer therapies for various cancers such as breast cancer, lung cancer, and prostate cancer, among others. Pharmaceutical companies are utilizing various drug modalities for developing precision cancer therapies. For instance, in 2023, the US FDA approved seven precision cancer therapies of which three were inhibitors and two were monoclonal antibodies. This large share is supported by rising collaborations and investments between pharmaceutical companies for developing precision therapies for various cancers, such as the 2024, collaboration between Boehringer Ingelheim and Circle Pharma to develop cyclin inhibitors to inhibit cancer cell growth.

Get 10% Free Customization on this Report

North America was the dominant region on the precision diagnostics market in 2023.

The North American precision diagnostics market emerged as the largest market for precision diagnostics in 2023, which is expected to remain the same during the forecast period. The large share of this regional market is supported by the presence of major diagnostics companies in the region that are actively focusing on developing novel precision diagnostics solutions for various disease areas. The presence of prominent academic and research institutions has also supported the large share of this market. Moreover, the rising prevalence of chronic disorders, such as cancer and autoimmune diseases, and increased investments and funding in precision medicine research in the region further boost the market of precision diagnostics in the region.

Key Market Players:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Agilent Technologies, Inc. (US)

- Thermo Fisher Scientific Inc. (US)

- Myriad Genetics, Inc. (US)

- Guardant Health (US)

- Abbott (US)

- Illumina, Inc. (US)

- Danaher (US)

- Exact Sciences Corporation (US)

- Qiagen (Netherlands)

- 23andME, INC. (US)

- ARUP Laboratories. (US)

- Devyser (Sweden)

- Diasorin S.P.A. (Italy)

- Tempus (US)

- Pillar Biosciences Inc. (US)

- Invivoscribe, Inc. (US)

- NeuroCode (US)

- C2N Diagnostics (US)

- Trinity Biotech Plc. (Ireland)

- Amoy Diagnostics Co., Ltd. (China)

- Novartis AG (Switzerland)

- Bristol-Myers Squibb Company (US)

- Gilead Sciences, Inc (US)

- AstraZeneca (UK)

- AbbVie Inc. (US)

- Eli Lilly and Company (US)

- Pfizer Inc. (US)

- GSK plc. (UK)

- Sanofi (France)

- Johnson & Johnson Services, Inc. (US)

- Vertex Pharmaceuticals Incorporated (US)

- Amgen Inc. (US)

- Merck KGaA (Germany)

- Sarepta Therapeutics, Inc. (US)

- Merck & Co., Inc.

- Natera, Inc.

Recent Developments of Precision Diagnostics and Medicine Market:

- In November 2024, Roche received CE Mark for its VENTANA FOLR1 (FOLR1-2.1) RxDx Assay, to identify epithelial ovarian cancer (EOC) patients eligible for ELAHERE (mirvetuximab soravtansine), for FRα-positive platinum-resistant ovarian cancer.

- In September 2024, Foundation Medicine entered into a collaboration with Syndax Pharmaceuticals to develop a companion diagnostic for identifying acute myeloid leukemia (AML) patients with the NPM1 mutation.