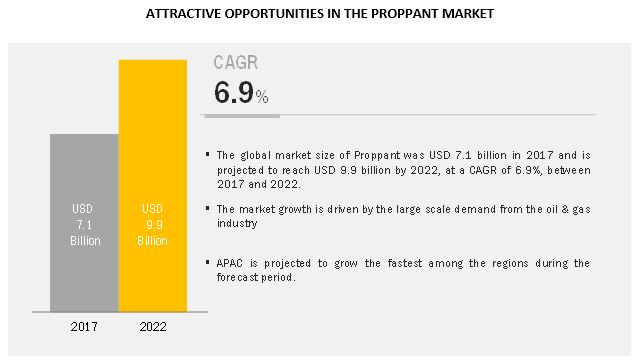

MarketsandMarkets: The Proppant Market size is projected to reach USD 9.9 billion by 2022, at a CAGR of 6.9% between 2017 and 2022. The increasing demand for proppant in hydraulic fracturing of shale gas, coal bed methane, and tight gas are driving the market.

♦ Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=802

Browse 129 market data Tables and 40 Figures spread through 133 Pages and in-depth TOC on “Proppant Market by Type (FRAC Sand Proppant, Resin-coated Proppant, and Ceramic Proppant) and Region (North America, Europe, Asia Pacific, South America, and the Middle East & Africa) – Global Forecast to 2022”

Frac-sand is estimated to be the largest type during the forecast period.

Frac sand accounted for the dominant share of the proppants market in 2018. Frac sand is the most-widely used type of proppant due to its easy availability and lowest cost. Ceramic proppant is the fastest growing type as it has high strength to withstand closure pressures up to 15,000 psi

Shale gas is projected to be the fastest-growing application segment of the proppants market during the forecast period.

Shale gas is projected to be the fastest growing application for proppants in 2018. The large scale demand from the shale reserves as well new shale gas projects in countries such as China are projected to boost the demand for proppants in the coming years

North America is estimated to be the largest market during the forecast period

North America is estimated to be the largest market for proppant. U.S. is expected to account for the largest share of the market globally till 2022 as the hydraulic fracturing market is mainly concentrated in the U.S. Major producers of proppant such as Carbo Ceramics Inc. (U.S.), Saint-Gobain Proppant Inc. (U.S.), U.S. Silica Holdings Inc. (U.S.), Hexion Inc. (U.S.), Fairmount Santrol Holdings Inc. (U.S.), Hi-Crush Partners LP (U.S.) and Superior Silica Sands LLC are located in the North America region. Asia-Pacific accounts for the second-largest share of the global proppant market and is projected to register the highest CAGR during the forecast period.

♦ Speak To Analyst – https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=802

This trend is projected to be witnessed till 2017 as operators are planning to consume even more proppant per lateral foot to continue driving IP and generate higher recovery rates. With the increasing use of fracking sand and improving the quality of wells, several exploration and production firms have also started increasing proppant use per well to help cope with slumping prices. EOG Resources (U.S.), Whiting Petroleum (U.S.), and Murphy Oil Corp (U.S.) are some of the companies that reported improvements in well performance owing to the use of significantly higher amounts of frac sand per well.

Since past few years, some proppants used to frack a single horizontal well were 1,000 to 3,000 tons. These figures changed significantly since 2014, with the proppants consumption per well estimated to be 8,000 to 10,000 tons. Also, several oil service companies, such as Halliburton, are investigating certain new fracturing techniques to consume 20 million pounds of frac sand instead of 5 million pounds (current utilization of frac sand per shale well) in a single well.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : +1-888-600-6441

Email: newsletter@marketsandmarkets.com

Visit Our Website: https://www.marketsandmarkets.com/