The market for rigid foam has been growing rapidly due to its excellent combination of properties such as energy conservation, high mechanical strength, along with the lighter weight as compared to other foams. Rigid foam plays an important role in modern building & construction, automotive, packaging, and other industrial applications due to its efficient thermal insulation properties. Moreover, key players operating in the rigid foam market have adopted various strategies to strengthen their positions. Investments and expansions were the key strategies adopted by leading players to achieve growth in the rigid foam market between 2013 and 2017.

Download PDF Brochure of this Full Report @ https://www.marketsandmarkets.com/pdfdownload.asp?id=48172921

In addition, investments and expansions, new product launches, mergers & acquisitions, partnerships & collaborations, and agreements were the other strategies adopted by companies to increase their shares in the rigid foam market and to strengthen their distribution networks.

BASF SE (Germany), The Dow Chemical Company (U.S), Huntsman Corporation (U.S.), Covestro AG (Germany), JSP Corporation (Japan), Borealis AG (Austria), Sealed Air Corporation (U.S.), Armacell International S.A ( Luxembourg), Nitto Denko Corporation (Japan), Woodbridge Foam Corporation (Canada), DS Smith Plc (U.K.), Kaneka Corporation (Japan), and Zotefoams Plc (U.K.) are some of the leading players operating in the rigid foam market.

BASF SE (Germany) is one of the leading companies in the rigid foam market. The company offers various types of rigid foam such as polyurethane, polyethylene, and polystyrene. The company is focusing on various strategies to increase its shares and strengthen its position in the rigid foam market. To maintain and enhance its market position, the company has focused on research and development to develop new products. For instance, in 2016, BASF SE expanded its portfolio with ecovio EA, the first expandable, closed-cell foam. The company has also created a global network of affiliates and production sites to enhance its product reach, maximize its customer base, and reinforce its leading position in the market.

In 2016, JSP Corporation (Japan) completed the construction of the Expanded Polypropylene (EPP) plant at JSP Foam Products in Thailand with an annual production capacity of 1,800 tons. The new facility will help to cater the increasing demand for ARPRO products in the automotive and other applications.

In 2013, Huntsman Corporation (U.S.) acquired Oxid L.P., (U.S.), a manufacturer of specialty urethane polyols (raw material for the manufacture of polyurethane insulation products) based in Houston, Texas (U.S.). It is a major raw material utilized to manufacture polyurethane foam used in insulation for walls, roofs, refrigerators, and various other applications. This acquisition has helped the company to strength its downstream capability and have a stronghold on the North American market.

The increasing demand for rigid foam from various end-use industries, such as building & construction, automotive, and packaging is expected to fuel the growth of the rigid foam market during the forecast period, 2017 to 2022. Excellent properties offered by this foam include low thermal conductivity, excellent chemical resistance, light weight, low-density structure, and high insulation value have led to the increased demand for rigid foam from various end-use industries. Recyclability is a growing concern across the globe, and the recyclability of rigid foam is further expected to lead to increased use of this foam in various end-use industries. Due to the variety of physical, chemical, thermal and mechanical properties, rigid foam is used as an insulation board in the building & construction, automotive, packaging end-use industries.

On the basis of type, the rigid foam market has been classified into polyurethane, polystyrene, polyethylene, polypropylene, polyvinyl chloride, and others. The demand for rigid polyurethane foam is expected to grow during the forecast period due to the increased adoption in various end-use industries.

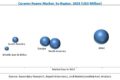

The Asia-Pacific rigid foam market is projected to grow at the highest CAGR during the forecast period, in terms of both, value as well as volume. The growth in the automobile and building & construction industries is expected to involve higher usage of rigid foam in the Asia-Pacific region. Countries such as China, South Korea, India, Indonesia, and Thailand, among others are witnessing a gradual increase in the use of rigid foam in various end-use industries. China led the Asia-Pacific rigid foam market, accounting for a market share of 59.6% in 2016. It is projected to remain the largest market during the forecast period for rigid foam in the Asia-Pacific region due to high economic growth rate of the countries, increasing purchasing power of consumers, developing infrastructure, and automobile advancements, leading to an increase in the demand for rigid foam from various end-use industries, and a global shift in the production capacities of various companies from the developed countries to China.

Companies operating in the rigid foam market are strengthening their R&D capabilities to develop new products which would increase energy efficiency and insulation. These products are manufactured by adhering to regulations formulated by various governments. BASF SE (Germany), The Dow Chemical Company (U.S), Huntsman Corporation (U.S.), Covestro AG (Germany), JSP Corporation (Japan), Borealis AG (Austria), Sealed Air Corporation (U.S.), Armacell International S.A (Luxembourg), Nitto Denko Corporation (Japan), Woodbridge Foam Corporation (Canada), DS Smith Plc (U.K.), and Kaneka Corporation (Japan) are some of the active players in rigid foam market.