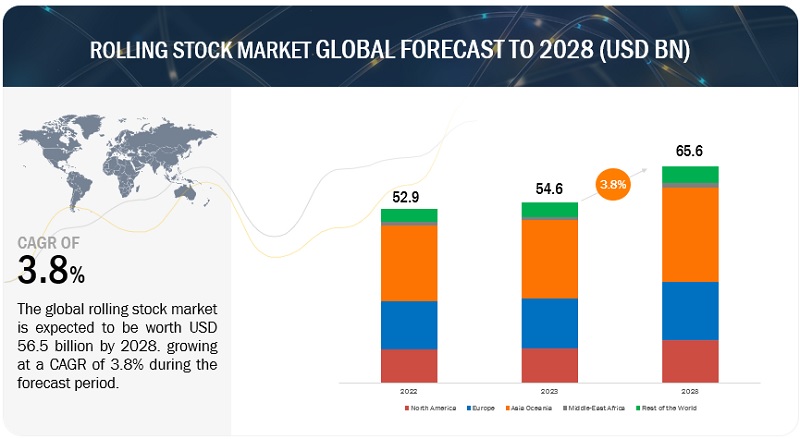

The global rolling stock market, by value, is estimated to be USD 28.6 billion in 2024 and is projected to reach USD 40.1 billion by 2030, at a CAGR of 5.8% from 2024 to 2030.

Development in the hybrid trains is providing opportunities for the market growth. Train with hydrogen or battery drive technologies are still on the way to the market and offer much more sustainable and flexible alternatives to traditional diesel-powered trains. These technologies make it possible for trains to run on non-electrified sections of rail networks, reducing reliance on fossil fuels and carbon emissions. Hydrogen-powered trains, as Alstom’s Coradia iLint, generate electricity from hydrogen fuel cells with water vapor as the byproduct. On the other hand, the battery train can be charged at the overhead wires or at stops to permit cleaner operations. Hybrid trains are increasing their market due to enhanced environmental awareness and an increasing demand for efficient and versatile transport solutions in different rail infrastructure environments. For instance, in April 2024, Germany launched Battery-powered train into service. The trains are Siemens Mobility Mireo Plus B battery hybrid trains, with four trains having been supplied to operate the service from Offenburg to Bad Griesbach and Offenburg to Hornbergin. Further, Innovative technologies like big data, intelligent rail systems, and connected rail are also influencing the growth of the market.

“Rapid Transit segment is expected to be the largest segment in the forecast”

The Rapid transit segment holds the largest market share in the product type segment. Factors such as increasing urbanization and the related need for fast, reliable public transport systems to cover spread-out metropolitan cities. With rising urban populations, the need for mass transit solutions to reduce traffic congestion and environmental pollution and to offer cost-effective and time-efficient travel options rises. Government support and investments in infrastructure development, technological development in rail systems, and increasing the focus on green and environmentally friendly transportation also fuel the growth of the rapid transit segment. Growth in existing transportation systems in cities has necessitated the demand for more rapid transit systems within metropolises. With the initiation of infrastructure projects, demand for vehicles is likely to be much stronger in emerging economies like China, Brazil, and India compared with the developed countries in Western Europe. Secondly, assimilation of smart technologies such as real-time tracking, automation, and advanced safety features enhances the attractiveness and uptake of rapid transit solutions. For instance, In July 2024, Paris transport authority Ile-de-France-Mobilities has awarded Keolis and RATP Cap Ile-de-France contracts to operate the future Grand Paris Express metro Line 18 and existing tram-train services T12 and T13 in Paris, France. Thus, with such new projects aimed toward rail connectivity, the demand for rolling stock will increase during the forecast period.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=4380892

“Passenger Transportation segment will hold the prominent market share in the Application segment”

Passenger segments hold the prominent market share in the application segment. Countries such as Japan, India, China, and Europe are major markets for rolling stock in passenger transportation. In Japan, rolling stock is the major means of passenger transport. The availability of robust infrastructure for both urban and intercity transport for mass transit in Japan is the major factor driving the adoption of railways for passenger transportation. Globally, there has been a rise in the demand for passenger trains, including those in Japan. In January 2024, Eurostar reported that they had transported 18.6 million passengers in 2023, a 22% increase over 2022 and marking a return to pre-pandemic passenger levels. According to American Public Transportation Association, Transit riders took 7.1 billion trips on public transportation in 2023, a 16 percent increase over 2022.

Urbanization is the major driver for the growth of passenger transportation by railways. According to WHO, the urban population is estimated to account for 60% of the global population by 2030. Hence, rising urbanization is expected to further boost the market for passenger transportation in the coming years.

“Europe is expected to be the second-largest market during the forecast”

It is projected that Europe will hold the second-largest share of the rolling stock market, by value, in 2024. Europe hosts the largest rail supply industry in the world. Most of the trains in Europe are fitted with high-tech facilities, including eco-friendly vehicles, wireless data communications, wireless radio hookups, and comfort-enhancing facilities. Compared with Western European nations like the UK, Germany, France, and Spain, the rate of adaptation of high-end technology remains pretty low in East European nations, including Poland and the Czech Republic. Rolling stock OEMs look to exploit the prospects of the Eastern European market toward regional presence.

Further, by 2030, EU Railways aims to construct a high-speed rail track of 31,000 km. Other programs, such as FP1MOTIONAL, FP2R2DATO, and FP3IAM4RAIL, are also conceptualized to increase the growth of the European rolling stock market. The EU is also seeking to develop environmentally friendly mode of transport by aiming for a single railway area. It has been attempting to harmonize the networks of the continent as a massive effort invested by both private and public entities. Germany is foreseen to dominate the European rolling stock market during the forecast period. The country is actively promoting the use of rapid transit systems to reduce vehicle emissions and is investing in appropriate infrastructure.

Key Players

The major players in global rolling stock market include CRRC Corporation Limited (China), Siemens AG (Germany), Alstom SA (France), Stadler Rail AG (Switzerland), and Wabtec Corporation (US). These companies offer extensive products and solutions for the railway industry; have strong distribution networks at the global level and invest heavily in R&D to develop new products.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=4380892