The silicon photonics market size was valued at USD 2.16 billion in 2024 and is projected to reach USD 7.52 billion by 2029, growing at a CAGR of 28.3% from 2024 to 2029.

The rising demand for new broadband connections and high-speed internet plans has prompted telecom service providers to invest in developing new network technologies, including silicon photonics. These technologies enable high-speed broadband connections and offer more broadband services over the existing network infrastructure. Television services’ distribution and consumption patterns have also evolved over the years as the most sophisticated broadband networks and evolving broadcast technologies offer consumers an enhanced viewing experience. The content broadcast to consumers has moved toward higher definition (HD), full HD, and ultra-high definition (UHD) services. The improving video quality has also boosted the demand for bandwidth allocation, resulting in the rising adoption of silicon photonics for television services.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=116

The increasing number of connected devices has made high-speed communication networks, such as 5G, necessary. Silicon photonics-based optical transceivers are essential in these markets to reduce errors and maximize the system’s transfer and receipt of information. Many telecom players worldwide have started implementing 5G, which presents an opportunity for optical transceiver OEMs that can provide 5G compatibility, low-latency services (typically data centers near the edge) and analytics. 5G is paving the way for the next wave of Internet of Things (IoT) innovation. The transition to 5G networks that can support the future of IoT requires access networks that can handle higher bandwidths than before.

The data centers and HPC segment is projected to grow at the highest CAGR during the forecast period. Manufacturing, energy and utility, chemical, government and defense, and education fields need HPC to handle large data volumes easily and simultaneously support high-performance data analysis. Along with this, HPC can also provide high accuracy and fast data processing. These benefits drive the adoption of high-performance computing, which, in turn, drives the demand for silicon photonics for this end user. The data centers and HPC is witnessing a significant rise in the adoption of silicon photonics, primarily due to the rising investments from cloud/hyperscale and colocation service providers. Investments in hyperscale data centers are steadily increasing, primarily with investments from Meta Platforms, Inc. (US), Amazon Web Services, Inc. (US), Microsoft Corporation (US), Google LLC (US), and Alibaba.com (China).

In North America, the US is expected to have to grow with the highest CAGR during the forecast period. There is huge potential for data center end users in the US owing to the presence of data centers of major technology giants such as Microsoft Corporation, Meta Platforms, Inc., and Amazon.com, Inc.; Microsoft Azure uses Intel’s silicon photonics transceivers for better and faster connectivity. The factors above fuel the demand for silicon photonics in the US. Canada is North America’s second-largest silicon photonics market, after the US. It is primarily due to its favorable geographical and political conditions attracting many companies to establish their data centers in the country.

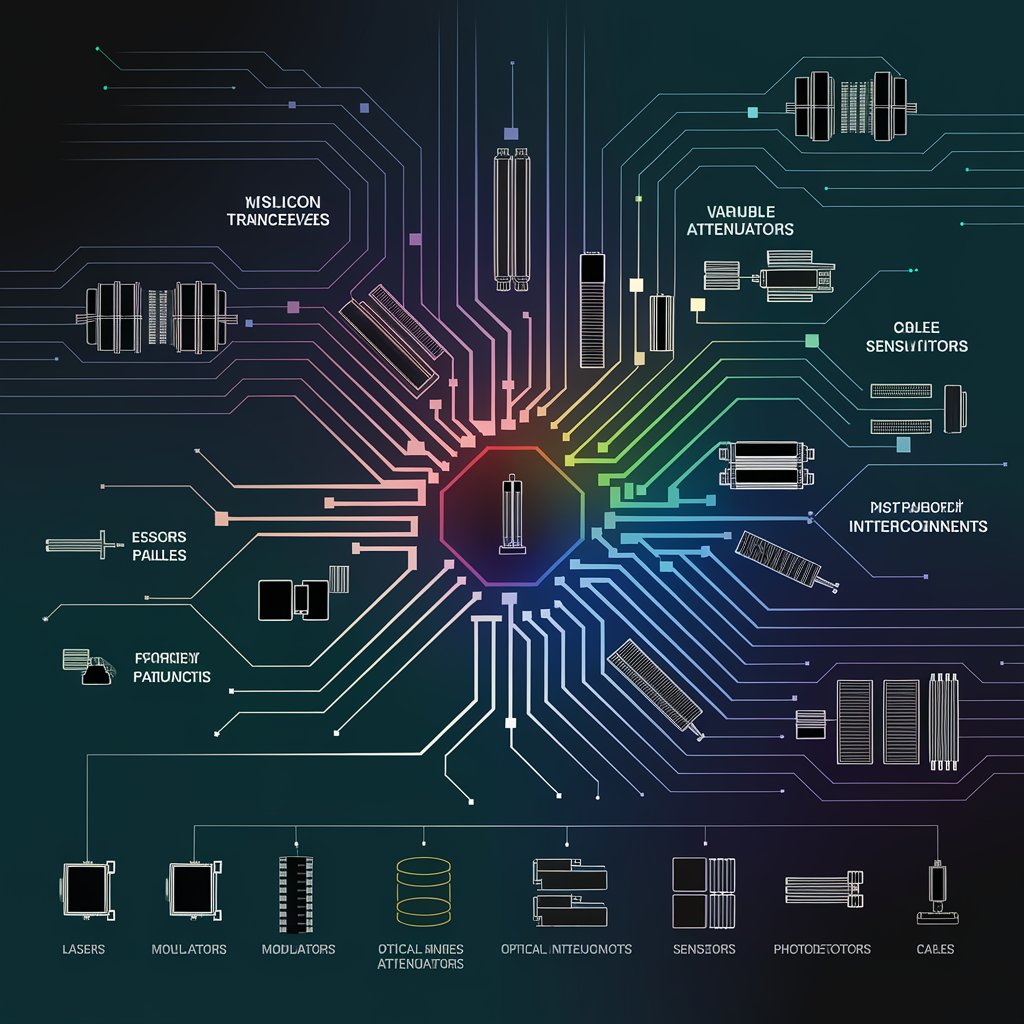

Key players in the silicon photonics market are Cisco Systems, Inc. (US), Intel Corporation (US), MACOM (US), GlobalFoundries Inc. (US), Lumentum Operations LLC (US), Marvell (US), Coherent Corporation (US), IBM (US), STMicroelectronics (Switzerland), Rockley Photonics Holdings Limited (US) among others. These players availed themselves of opportunities like indulging in partnerships and acquisitions. Product development and expansion were a few other strategies adopted by companies to strengthen their market position.