Smart elevators are proving to be fast and more energy efficient in comparison to the conventional elevators. The huge demand for these energy-efficient elevators combined with the rapidly increasing construction activities across the globe are expected to boost the market growth, surpassing the USD 26 Billion market by the end of 2022. They help in minimizing the overall energy consumption and managing of passenger traffic in an efficient manner in residential and other buildings. With the continuous developments and innovations in technology and improving lifestyles, the demand for safety and energy-saving solutions has also increased over the past few years.

Sample pages of the Report : http://www.marketsandmarkets.com/requestsample.asp?id=1004

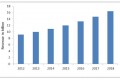

According to the researchers, the global smart elevator market which was valued at USD 9.54 Billion in 2015 is predicted to reach USD 26.69 Billion by the end of 2022, growing at a CAGR 15.6% between 2015 and 2022. Among regions, North America was the dominant market in 2015 since the presence of ICT technologies is more in this region as compared to other regions like APAC and RoW, whereas Asia-Pacific is expected to grow at the highest CAGR during the forecast period. Based on services, the modernization of existing elevators is the current dominant segment; however, over the coming years, the new installation services market is expected to be the leading market.

Why APAC is considered a favorable destination for this market to flourish?

APAC comprises countries namely, India, China, Japan, Taiwan, and South Korea. All these countries are offering lucrative opportunities for elevator manufacturers because of untapped market opportunities. India and China collectively accounted for significant share in world population, considering the ongoing economic activities in these countries like development of smart cities, special economic zones, and expansion of major companies. Moreover, the investments in these countries have been on a rise since the past few years. For instance, India attracted nearly USD 40.0 Billion FDI in construction sector between 2000 and 2013. Such initiatives clearly support the APAC market as the favorable destination for smart elevators.

How is the residential sector majorly benefiting the growth of this market, globally?

Urbanization is the key trend primarily driving growth in the residential market across the globe. It can also be seen as leading factor that supported high standard of living over the past few years. The automation and control enhanced the standard of living in every sphere, and this trend is also applicable for smart elevators as well. High rise buildings have increased over the last two decades, and smart elevators have proved to be best mode of vertical transportation in these buildings. Moreover, smart elevators were found to be the best way to provide security, avoiding unauthorized entry in residential and other buildings.

What are the major developments in the global smart elevator market?

The major development in smart elevator market is the association of companies with IT giants like Microsoft and IBM. Over the last three years, it was observed that all the major elevator manufacturers have entered into partnerships with major companies in IoT industry. Association with IoT companies helped manufacturers to integrate their services and strengthen their position in smart elevator industry.

What will drive the progress of global smart elevator market?

The factors such as increasing demand for energy efficient systems, rapid urbanization, growing construction & real estate industry, high demand for security, and rising adoption of wireless technologies are the key factors driving the global market for smart elevators towards substantial growth.

Major challenges faced by this market

Since industry is capital intensive, it is not easy for a small and medium scale companies to enter into this market, thus making the entry barrier as one of the major challenges for the market players. Also, the major four players, namely Otis, KONE, Schindler, and Thyssenkrupp elevators govern approximately 60-70% of the overall market. Hence, the existing small companies are finding it difficult to compete with them, as heavy investments in R&D is required to match up with their offerings. In addition to this, market consolation is also a key challenge as many small companies are being acquired by the aforementioned four major players in this industry.