Latest report “Smart Water Metering Market by Meter Type (Electromagnetic, Ultrasonic, Mechanical), Technology (AMI, AMR), Component (Meters & Accessories, IT Solutions, Communications), Application (Water Utilities, Industries), and Region – Global Forecast to 2024″, is projected to reach USD 9.6 billion by 2024 from an estimated USD 5.9 billion in 2019, at a CAGR of 10.3% during the forecast period. The growing concern toward managing the supply of water is a driving factor for the market. Moreover, the adoption of the Internet of Things in the water industry is bringing opportunities for the market.

Key Market Players:

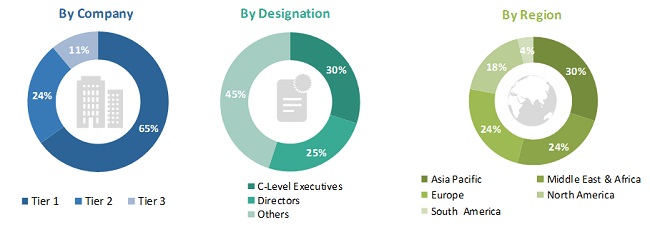

The major players in the global smart water metering market are Kamsturp (Denmark), Badger Meter (US), Diehl (Germany), Landis+Gyr (Germany), Itron (US), Neptune Technology Group (US), Aclara Technologies (US), Sensus (US), BMETER (Italy), Datamatic (US), Honeywell (US), and ZENNER (Germany).

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=250996975

The ultrasonic meter segment is expected to be the fastest growing smart water metering market, by meter type, during the forecast period

The ultrasonic meter segment of the smart water metering market, by meter type, is expected to grow at the fastest rate during the forecast period. This is mainly because ultrasonic meters deliver highly accurate data outputs than mechanical and electromagnetic meters. These meters are equipped with sensors that can measure the water velocity and then convert it into the water flow rate. Moreover, ultrasonic meters have a longer life span, and they are able to transmit real-time data using communication network connectivity; the data is analyzed by meter data management systems or central monitoring software platforms.

The AMR segment is expected to dominate the smart water metering market, by technology, during the forecast period

AMR is a key driver of proficiency for water utilities. It helps in lowering operational costs by optimizing maintenance and reducing human intervention in the measurement operation. AMR is a system and process used to remotely collect water meter data without the physical presence of personnel at the reading point. North America and Europe are the regions mostly implementing this technology. Other regions have also started implementing this metering infrastructure to reduce nonrevenue water.

North America: The largest smart water metering market

In this report, the smart water metering market has been analyzed with respect to 5 regions, namely, North America, South America, Europe, Asia Pacific, and the Middle East & Africa. The dominance of the region is mainly due to high installation rate of smart water meters by the North American water utilities. Also, the region is the highest consumer of water in the world. Smart water meter suppliers are focusing on expanding their offerings in the North American region to help customers reduce the water bills as the smart water meters detect water leakages and turn off the supply in case of water losses. Ultrasonic meters are gaining more preference by the water utilities in North America due to higher efficiency and more accurate rates.

Request Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=250996975

Report Objectives:

- To define, describe, segment, and forecast the smart water metering market by type, meter type, component, end-user, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the main regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To profile and rank key players and comprehensively analyze their market shares

- To analyze competitive developments such as contracts & agreements, expansions & investments, new product launches, mergers & acquisitions, joint ventures, and partnerships & collaborations in the smart water metering market