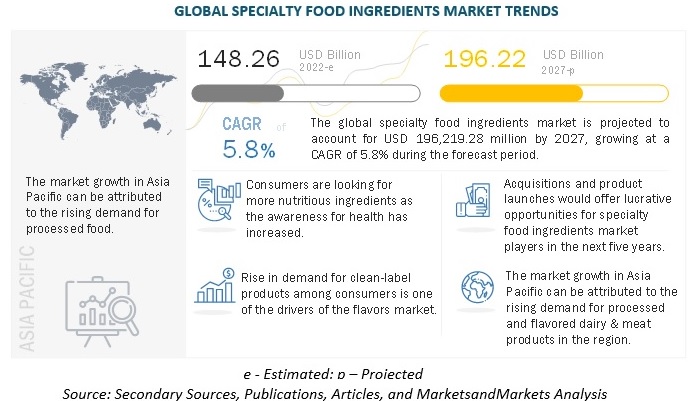

The global specialty food ingredients market is estimated to be valued at USD 148.2 billion in 2022. It is projected to reach USD 196.2 billion by 2027, recording a CAGR of 5.8% during the forecast period. Specialty food ingredients constitute distinct functional ingredients, sugar substitutes, flavors, specialty starches, acidulants, food preservatives, food emulsifiers, colors, food & beverage enzymes, and F&B starter culture. Specialty food ingredients improve the texture, increase shelf life, preserve product properties, and increase the product’s nutritional value. Therefore, there is an increase in demand for applications in food products such as jams, jellies, bakery premixes, dairy products, meat & dairy substitutes, pharmaceutical products, personal care products, and cosmetics.

Acidulants are widely used in beverages made with fruit flavors, such as fruit-flavored carbonated water drinks. The development of the food & beverage industry has led to a substantial increase in demand for processed foods. These processed food products require acidulants as flavor enhancers and acidity regulators. Beverage acidulants find application in soft drinks, dairy products, and energy drinks. The rise in the popularity of energy drinks is likely to add impetus to the global beverage acidulants market. Based on application, this study’s acidulants market has been further segmented into beverages and food products, including sauces; dressings & condiments; processed food; meat, poultry, and seafood; bakery & confectionery; and other products. The demand for acidulants is propelling within the confectionery sector. Gummy candy formulations made with gelling acidulant offer optimal gelling activity and control the set time. For instance, Bartek strategically adds acidulants to manufacture enhanced properties in confectionery products.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=252775011

Natural colors are in demand for their health benefits along with imparting color. The increasing demand for natural food colors by consumers in different regions has led manufacturers to use natural food colors as a substitute for synthetic colors. The demand for natural food colors over synthetic food colors is increasing due to the growing consumer awareness of consumers about clean-label products, the health hazards associated with synthetic colors, and the health benefits achieved by using natural food colors. Natural food colors are gaining market attention due to their natural origin, appealing to consumers who view them as a “safe to use” product. Natural colors reduce the risk of allergies and intolerance among consumers. Such factors are increasing demand for natural colors in food & beverage applications. In the EU, natural colors have high penetration. Companies are now vying for natural colors in the food & beverage sector. Dairy, sugar & gum confectionery, and desserts & ice cream are the leading sectors for utilizing natural colors.

The US holds the largest market for enzymes in North America. It is attributed to the growing demand from food manufacturers to preserve the freshness, appearance, texture, taste, and safety of processed and packaged foods. The growing demand for processed foods, owing to food retail chains and convenience, will aid in increasing demand for enzyme applications in the region. Consumers in the region are leaning towards healthy food & ingredients in food products, owing to the increasing instances of obesity and diabetes in North American countries, such as the US, which is expected to induce the consumers to focus on enzyme-rich foods.

The key players in this market include Cargill Incorporated (US), ADM (US), DuPont (US), Ingredion (US), Kerry Group (Ireland), DSM (Netherlands), Chr. Hansen (Denmark), Sensient technology corporation (US), Tate & Lyle (UK), Givaudan (Switzerland).