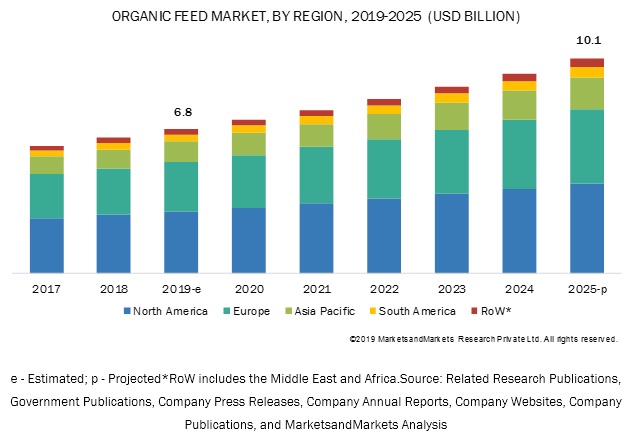

The global organic feed market size is estimated at USD 6.8 billion in 2019 and is projected to reach USD 10.1 billion by 2025, recording a CAGR of 6.8% during the forecast period. The expansion of the organic food industry due to the increasing demand for organic dairy and poultry products and growing health concerns related to the use of antibiotics, pesticides, and feed additives in feed products are some of the key factors that are projected to drive the growth of the organic feed market. North America is a key revenue generator for organic feed manufacturers. In North America, the US witnesses the increasing number of players operating in the market and the availability of raw materials that are used for developing organic feed products, such as soybean and wheat.

Based on type, the cereals & grains segment accounts for the largest share in the organic feed market. The cereals & grains segment, for the purpose of this study, include corn, wheat, and barley. The US is among the largest producers of corn and wheat, which are the primary raw materials used for manufacturing organic feed. According to the 2016 Certified Organic Survey (2015 to 2016), the US organic corn acreage increased from 166,841 million tons in 2015 to 213,934 million tons in 2016. Most of this production was used in organic feed manufacturing. This shows the high growth prospects for organic feed manufacturers in the country.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=158519224

Based on form, the mash microbe segment accounted for the largest share in the organic feed market in 2018. Mashed organic feeds are used majorly in ruminants and poultry livestock. Hence, the increased demand for organic dairy and poultry meat products is projected to drive the consumption of organic feed at a global level. In the dairy industry, the demand for organic milk segment is projected to witness higher demand in comparison to the others segment such as organic poultry meat and organic eggs.

Based on livestock, the poultry segment accounted for the largest share in the organic feed market in 2018. The poultry industry provides a range of products for human consumption, such as eggs and poultry meat. Poultry is a key revenue-generating segment for organic feed manufacturers as the demand for poultry products remains high in most of the countries at a global level. It is considered a cheap source of protein and is witnessing increased sales in the emerging countries of Asia Pacific and South America regions.

North America was the largest market for organic feed in 2018. In North America, key players operating in the organic feed market include Cargill (US), SunOpta (Canada), and Purina Animal Nutrition LLC (US). The demand for organic feed is projected to increase in the poultry industry across regions. The US is among the largest producers and consumers of corn, wheat, and soybean at a global level. These ingredients are used on a large scale in the feed industry and with the latest trend of increasing consumer preference for natural ingredients, the demand for these ingredients is projected to increase in the coming years.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=158519224

In Canada, small scale players offer organic feed for poultry, swine, and ruminant. In Mexico, the demand for organic poultry products, such as eggs and poultry meat, is projected to create lucrative opportunities for organic feed manufacturers. Milk is also projected to witness an increase in the consumption of organic feed for ruminant livestock, as consumers prefer opting for organic dairy products in the region. Thus, North America is projected to create high growth prospects for organic feed manufacturers in the coming years.

Organic feed manufacturers are focusing on expanding their consumer base in the market. Leading players operating in the organic feed market include Cargill (US), Purina Animal Nutrition LLC (US), SunOpta (Canada), ForFarmers (Netherlands), BernAqua (Belgium), Aller Aqua (Denmark), K-Much Feed (Thailand), The Organic Feed Company (UK), Scratch and Peck Feeds (US), B &W Feeds (UK), Hi Peak Feeds (UK), Country Heritage Feeds (Australia), Feedex Companies (US), Country Junction Feeds (Canada), Green Mountain Feeds (US), Ranch-Way Feeds (US), Unique Organics (India ), Kreamer Feed (US), Yorktown Organics LLC (US), and Green Miller (India).