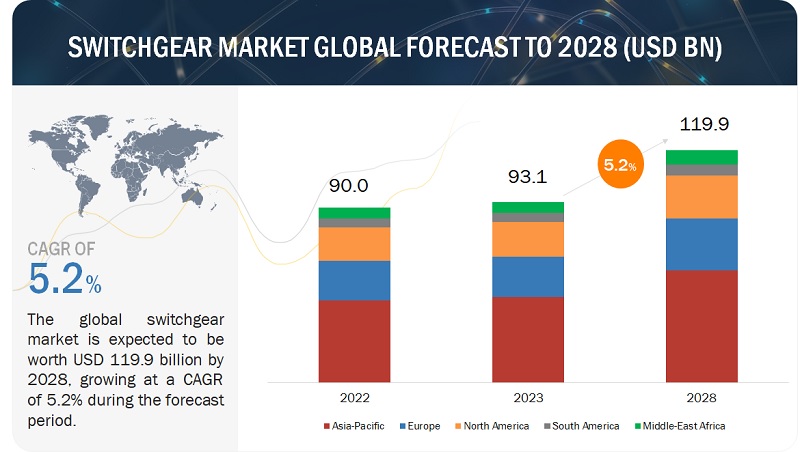

According to a research report “Switchgear Market by Insulation (Gas-insulated, Air-insulated), Installation (Indoor, Outdoor), Current (AC, DC), Voltage (Low (up to 1 kV), Medium (2-36 kV), High (Above 36 kV), End User and Region – Global Forecast to 2028″ published by MarketsandMarkets, the market size for switchgear is projected to reach approximately USD 119.9 billion by the year 2028, as compared to the estimated value of USD 93.1 billion in 2023, at a Compound Annual Growth Rate (CAGR) of 5.2% over the forecast period.

The switchgear market is poised for substantial growth during this period, primarily due to the development of power distribution infrastructure in response to the growing demand for electricity. Furthermore, the expansion of renewable energy-based capacity and increased investments in industrial production are likely to drive the demand for switchgear.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1162268

High voltage segment, by voltage, to occupy majority of switchgear market share.

During the forecast period, the high voltage segment, categorized by voltage, is expected to secure a dominant market share. High-voltage switchgears, operating above 36 kV, are crucial in transmission, heavy industries, mining, railways, and commercial infrastructures. The main component, a high-voltage circuit breaker, is integral. Gas-insulated switchgears are prevalent in these applications. Typically placed outdoors due to space requirements, they consist of circuit breakers, isolators, transformers, and bus bars. Faulty tripping is rare, and these switchgears often remain ON for extended periods. They play a vital role in renewable power transmission and medium-voltage substations. As electrification and renewable integration rise, the demand for high-voltage switchgear, especially automated and smart ones for smart grids, is expected to surge in the forecasted period.

Commercial & residential segment, by end user, to be third-largest and third-fastest market.

Urbanization, particularly in regions like Asia Pacific, South America, and Africa, is driving a surge in commercial and residential constructions. As urban centers grow due to economic opportunities, the need for housing and commercial buildings escalates. Switchgear plays a vital role in supplying, safeguarding, and regulating power for various equipment in these constructions. Additionally, contemporary switchgears are engineered to handle earth leakage current faults, enhancing their safety features. Consequently, the demand for switchgear in commercial and residential applications is anticipated to rise significantly in the coming years.

North America to emerge as the third-largest switchgear market.

During the forecast period, North America is anticipated to hold the third-largest market share in the global switchgear market. Encompassing the US, Canada, and Mexico, the region boasts extensive trade ties and significant foreign investments, with the US and Canada jointly contributing around 93.8% to North America’s switchgear market. With a combined population of nearly 530 million and an economy representing over one-quarter of the world’s GDP, the region faces substantial power demands, leading to increased investments in fortifying and modernizing its transmission and distribution utilities. Notably, energy consumption per capita in North America saw a 4% rise, according to the BP Statistical Review of World Energy 2022.

The region is undergoing a transformative phase in its utilities sector, marked by a shift towards digital operational strategies focusing on decentralization, digitization, and decarbonization of power systems. Aging power infrastructures, constituting nearly 72% of the US power infrastructure beyond 25 years of service, pose a blackout risk, prompting active government initiatives to upgrade and replace these structures for enhanced grid reliability.

Request Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=1162268

Key Players

Key players in the global switchgear market include ABB (Switzerland), General Electric (US), Siemens (Germany), Schneider Electric (France), and Eaton (Ireland).