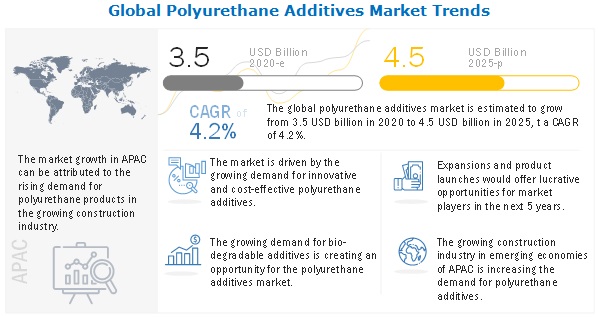

The polyurethane additives market size is projected to reach USD 4.5 billion by 2025 at a CAGR of 4.2% from 2020. The demand for polyurethane additives in emerging economies, such as APAC and South America, is increasing owing to the growing construction industry. The volatility in raw material prices and the recyclability of polyurethanes is hindering the polyurethane additives market. This increase in demand for bio-based polyurethane additives provides growth opportunities to the market. On the other hand, the increasing regulatory pressure towards the usage of bio-based products is the major challenges for the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=121317889

Flexible polyurethane foam is an important material finding usages in mattresses, furniture cushioning, bedding, carpet underlay, automotive interiors, etc. These being highly cellular polymers are easily ignitable. This characteristic limits their greater use in areas that require them to pass certain fire regulations as fire hazards are associated with the use of these polymeric materials, which can cause loss of life and property, are of particular concern among government regulatory bodies, consumers, and manufacturers alike. This further drives the demand for innovating new additives such as flame retardants to reduce the flammability of polyurethanes. A large range of flame retardants such as inorganic phosphorus, organophosphorus, nitrogen, halogen, and phosphorus-halogen based compounds are used to meet the demand for the required additives.

The foams application to be the largest consumer of polyurethane additives

Polyurethane foams are manufactured by reacting polyols and isocyanates in the presence of a blowing agent and an amine catalyst. The blowing agent is carbon dioxide, which is formed as a by-product of the reaction between water and isocyanate. The amine catalyst is known to accelerate the reaction. Polyurethane foams are of two types, namely rigid polyurethane foam and flexible polyurethane foam. Foams offer various properties such as comfort and insulating properties when used in various industries such as automotive and building & construction, which is driving the market.

The automotive & transportation industry to be the largest consumer of polyurethane additives

Polyurethanes are used in various parts of an automobile. In addition to the foam that makes car seats comfortable, bumpers, interior “headline” ceiling sections, the car body, spoilers, doors and windows all use polyurethanes. Polyurethane enables manufacturers to provide drivers and passengers significantly more automobile mileage by reducing weight and increasing fuel economy, comfort, corrosion resistance, insulation, and sound absorption.

The recent COVID-19 pandemic is expected to impact the global automotive industry. The entire supply chain is disrupted due to limited supply of parts. For instance, Hubei province in China, which accounts for 8–10% of the Chinese auto production, is severely impacted by pandemic. Chinese suppliers around the globe have placed production lines on halt or shut them down completely. The legal and trade restrictions, such as sealed borders, increase the shortage of required parts. Such disruptions in supply chain is expected to affect the assembly of OEMs in Europe and North America.

Request for Sample Request: https://www.marketsandmarkets.com/requestsampleNew.asp?id=121317889