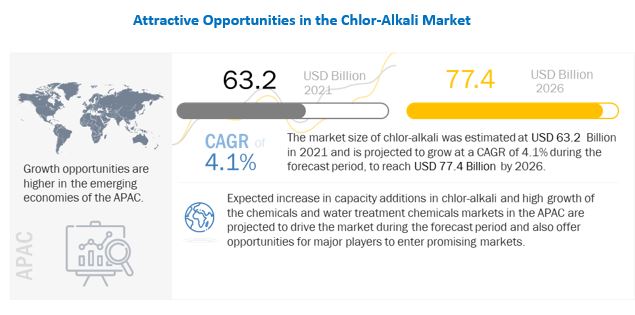

The global Chlor-Alkali market size is estimated to be USD 63.2 billion in 2021 and is projected to reach USD 77.4 billion by 2026, at a CAGR of 4.1% between 2021 and 2026. The growth in demand for chlor-alkali in the APAC is expected to be driven by the vinyl chain (EDC/VCM/PVC). The demand for chlor-alkali in the APAC is driven by China, which accounts for a major share, globally. China is one of the fastest-growing countries, in terms of chlor-alkali consumption, due to its large chemical and petrochemical industries. India, with its emerging economy is expected to propel the demand for chlor-alkali products during the forecast period. The rising disposable income and focus on the domestic manufacturing industry is expected to increase the demand for chlor-alkali products. However, in Europe, the market for chlor-alkali products is projected to grow at a marginal rate during the forecast period. In North America, and particularly in the US, the growth in demand for chlorine is expected to be driven by the vinyl chain (EDC/VCM/PVC). New capacities are expected to be introduced as the demand from the vinyl industry is projected to increase due to the rising demand from the construction and residential housing sectors in the US.

Chlor-alkali products, namely, chlorine, caustic soda, and soda ash are utilized in various industries. Chlorine and caustic soda are produced through the electrolysis of brine, and soda ash is produced through the Solvay process. These three products are used as raw materials in various industries; chlorine is a vital building block and more than 60% industrial chemicals require it in some form or other in production processes. Caustic soda finds applications in personal care products such as soaps and detergents. Soda ash is used in the glass industry, chemicals, and for water treatment. Some applications such as water treatment, food, and pulp & paper are common in all the three chlor-alkali products

To know about the assumptions considered for the study download the pdf brochure

The Chlor-Alkali market is segmented on the basis of type as Chlorine, Caustic Soda, Soda Ash, and others. Chlorine plays an important role in various chemical industries. It is a building block in chemistry because of its reactivity and bonding characteristics. It is produced by electrolysis, majorly with the use of the membrane cell technology. Some of the manufacturers use diaphragm technology and mercury cell technology. Chlorine reacts with almost all elements, except lighter noble gases. It is a good disinfectant and bleaching agent. Chlorine applications includes EDC/PVC, organic chemicals, inorganic chemicals, isocyanates, chlorinated intermediates, propylene oxide, pulp & paper, C1/C2/ aromatics, water treatment, and others.

The major industry players have adopted expansions, agreements, and acquisitions as growth strategies in the last four years. The leading players in the market are Olin Corporation(US), Westlake Chemical Corporation (US), Tata Chemicals Limited (India), Occidental Petroleum Corporation (US), Formosa Plastics Corporation (Taiwan), Solvay SA (Belgium), Tosoh Corporation (Japan), Hanwha Solutions Corporation (South Korea), Nirma Limited (India), AGC, Inc. (Japan), Dow Inc. (US), Xinjiang Zhongtai Chemical Co. Ltd. (China), INOVYN (UK), Ciner Resources Corporation (US), Wanhua-Borsodchem (Hungary), and others.

Olin Corporation manufactures chemicals and ammunition. Its business is divided into three segments, Chlor Alkali Products and Vinyls, Epoxy (epoxy materials and precursors), and Winchester (arms and ammunition). Its Chlor Alkali Products include chlorine and caustic soda, methyl chloride, methylene chloride, ethylene dichloride & vinyl chloride monomer, chloroform, hydrochloric acid, simultaneously with 1 ton perchloroethylene, carbon tetrachloride, trichloroethylene, bleach products, hydrogen, and potassium hydroxide. The Chlor Alkali and Epoxy businesses were added to the company as a spin-off from The Dow Chemical Company in 2015. The company produces chlorine, caustic soda, and hydrogen through the electrolysis of salt, also known as Electrochemical Unit (ECU). These products are produced simultaneously in the proportion of 1 ton of chlorine to 1.1 tons of caustic soda and 0.03 tons of hydrogen. The company offers these chlor-alkali products for polyvinylchloride (PVC), water treatment, alumina, pulp & paper, detergents & soaps, and other applications. It has seven production facilities for chlorine and caustic soda in the US and Canada. It has a strong presence in North America and also offers its products across Europe, the Asia Pacific, and Latin America.

Westlake Chemical Corporation is a global manufacturer and supplier of petrochemicals, vinyls, polymers, basic chemicals, and building products. The company operates its business through two segments: Vinyls and Olefins. The Olefins segment includes petrochemical products; and ethylene and styrene monomers. The Vinyls segment includes polyvinyl chloride (PVC), vinyl chloride monomers (VCM), ethylene dichloride (EDC), chlor-alkali (chlorine and caustic soda), chlorinated derivative products, and other related products. The company offers products for the packaging, healthcare, automotive, consumer goods, and other sectors. It has an overall production capacity of 22.1 million tons/ year (44.3 billion lbs/yr). It has manufacturing facilities for chlor-alkali products in the US and Germany. The chlorine is utilized for the production of vinyl chloride monomers (VCM), chlorinated derivative products, and supplied to industries. Caustic soda is utilized for the production of alumina, pulp & paper, organic & inorganic chemicals, and others. The company has business operations in North America, Europe, and the APAC.

In 2020, the Chlor-Alkali market saw a dip in growth rate due to COVID-19 and the consequent lockdown across the world. End-use industries such as construction, automotive, pulp & paper, and others were significantly impacted by COVID-19. Due to economic losses, several production activities were suspended until the recovery of the economy. This decline in the manufacturing industry across the globe, in turn, resulted in a decline in the demand for chlor-alkali products. However, the market is expected to grow steadily during the forecast period, with business operations returning to normal.

The companies have initiated the following developments:

- In July 2021, Olin Corporation entered into an agreement with ASHTA Chemicals, Inc. (US) to buy and sell chlorine which is produced at ASHTAs Ohio facility in the US.

- In January 2021, Formosa Plastic Corporation announced the expansion of production facilities based in the US, Taiwan, and China.

- In December 2019, Tata Chemicals acquired 25% partnership interest in Tata Chemicals (Soda Ash) Partners Holdings from The Andover Group, Inc., a subsidiary of Owens-Illinois Inc. for USD 195 million. Through this, the company gained full ownership of Tata Chemicals (Soda Ash).