Overview

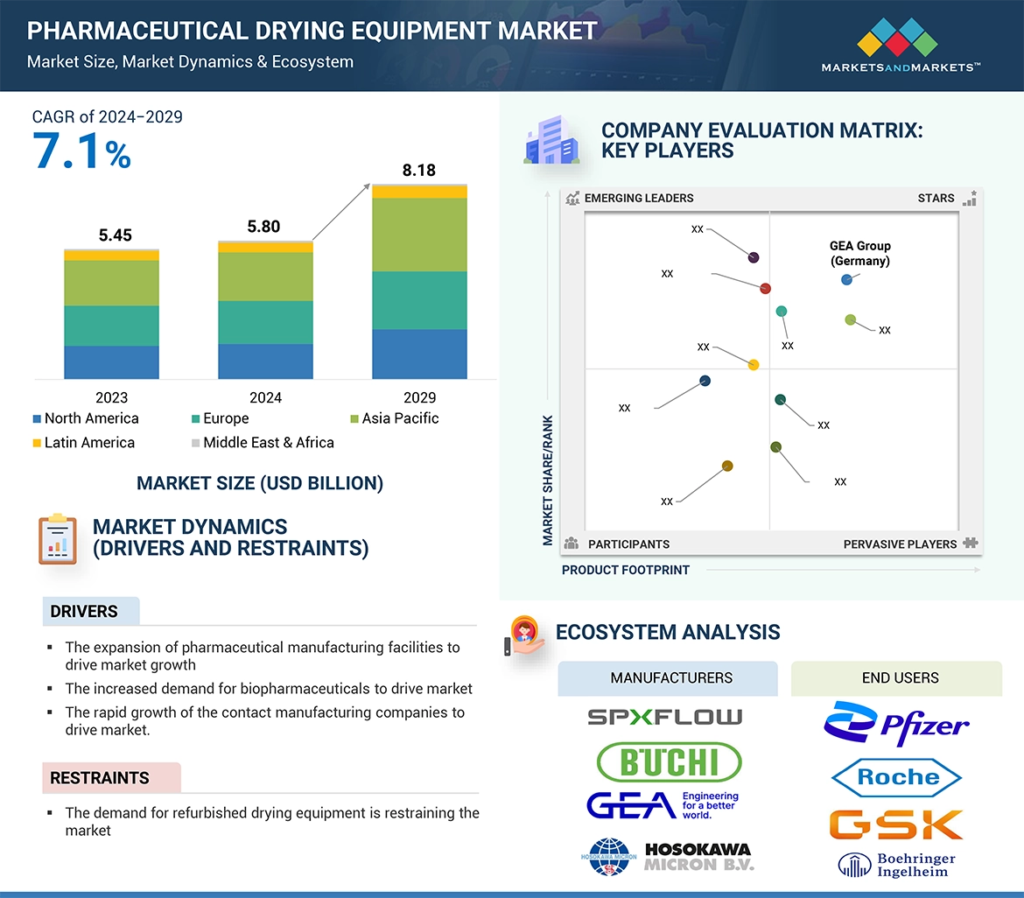

The global pharmaceutical drying equipment market is projected to reach USD 8.18 billion by 2029 from USD 5.80 billion in 2024, at a CAGR of 7.1% during the forecast period. The expansion of pharmaceutical manufacturing facilities globally, increased demand for biopharmaceuticals such as vaccines, antibodies, and hormones, and the rapid growth of CMOs drive market growth. The market has grown considerably due to the expansion of pharmaceutical manufacturing facilities and the rapid development of CMOs and CDMOs. At the same time, the rising competition in pharmaceutical manufacturing companies due to the loss of various drug’s market exclusivity will pose an opportunity to the market.

Download an Illustrative overview

Global Pharmaceutical Drying Equipment Market Dynamics

DRIVER: Increasing expansion of pharmaceutical manufacturing facilities

The market for pharmaceutical drying equipment is expanding due to the growing number of pharmaceutical manufacturing facilities opening up worldwide. The need for pharmaceuticals is rising in tandem with the frequency of chronic diseases. The incidence and prevalence of chronic diseases have been on the rise globally. As a result, pharmaceutical manufacturing facilities have expanded their operations and created new facilities due to the rising demand. In March 2023, Takeda Pharmaceuticals invested in a new plasma-derived therapy production facility in Japan for 100 billion Yen (USD 0.75 billion). Also, in July 2024, BeiGene commenced its clinical R&D center and biologics manufacturing facility in the US. Thus, innovative pharmaceutical drying equipment is required for these expansions to process APIs effectively and preserve product quality. The pharmaceutical industry needs drying equipment that can handle different formulations without compromising quality as they concentrate on creating novel medicines and improving manufacturing efficiency. Consequently, the market for pharmaceutical drying equipment has expanded and is also projected to grow due to the increasing number of facilities alongside the development of the existing manufacturing processes.

RESTRAINT: Demand for refurbished drying equipment

The increasing demand for reconditioned drying equipment has restrained the pharmaceutical drying equipment market. Many pharmaceutical businesses have replaced their expensive machinery with refurbished options as a more cost-effective way to reconcile cost-efficiency and operational requirements. Refurbished drying equipment presents an alternative for companies looking to reduce expenses; this is particularly valid for new businesses or companies based in emerging economies. This trend toward adopting refurbished solutions instead of new machinery may cause the market for new pharmaceutical drying equipment to slow down dramatically, as manufacturers may prioritize cost concerns above technological advancements. However, refurbished drying equipment does not constantly have updated operational formats, which affects the drying technique, offering a risk to product quality. The increase in the use of refurbished equipment might further be sustained. At the same time, organizations weigh the potential of cost efficiencies achieved by employing standards against emerging the choice of using new technology developments and those created by compliance demands of regulations; this proves to be quite tasking, especially for producers of new drying solutions. Therefore, this shift towards used equipment is a significant challenge to future market growth.

OPPORTUNITY: Increasing focus on personalized medicine

The increasing competition in the pharmaceutical manufacturing industry has increased due to loss of market exclusivity for various drugs. The key patents are expiring, and new generic and biosimilar products are expected to enter the market. For instance, the patents of drugs such as GSK’s Dolutegravir (2027–2029), Bristol Myers Squibb’s Revlimid (2025–2026), and Merck & Co.’s KEYTRUDA (2028) are all scheduled to expire. Due to this loss of exclusivity in coming years, producers of biosimilars and generics will have to increase their production capacity to gain market share in this competitive climate. Thus, many companies have aimed to expand their manufacturing facilities and capture the market. For instance, Sandoz, a well-known global producer of generic and biosimilar drugs, plans to invest at least USD 400 million in a new biologics facility in Slovenia; its operations will commence in late 2026. The demand for pharmaceutical drying equipment will rise due to this development in manufacturing capacity. These new facilities will need to use cutting-edge drying technologies to guarantee the effectiveness and caliber of their production processes. Consequently, the market for pharmaceutical drying equipment has expanded due to competition from drug patents that are about to expire.

CHALLENGES: Higher maintenance of the pharmaceutical drying equipment

The higher maintenance required is a significant challenge for the market’s growth for pharmaceutical drying equipment. For drying equipment to operate well, it must be calibrated and maintained correctly. Ineffective drying operations can result from inadequate maintenance. Thus, the operation cost increases, and the quality of pharmaceutical products is lowered; this impacts the equipment’s overall performance and longevity. Ill-maintained equipment also does not provide the company with genuine effects for their products, hampering market growth. The pharmaceutical industry has maintained strict regulations for companies for their pharmaceutical drying equipment, and failure to comply with these regulations can hamper the product’s quality and efficacy, making adequate maintenance one of the prime focuses. However, manufacturers may find it challenging to bear routine maintenance expenses. As this equipment is costly, it needs efficient maintenance and calibration. These continuous maintenance needs can burden resources and reduce profitability for many businesses, notably smaller or medium-sized firms. As a result, the difficulty of overseeing high maintenance requirements may discourage investment in new drying machinery and impede the market’s overall expansion for pharmaceutical drying machinery.

Get 10% Free Customization on this Report

Global Pharmaceutical Drying Equipment Market Ecosystem Analysis

The ecosystem of the pharmaceutical drying equipment market comprises elements present in this market, and these elements are defined with a demonstration of the bodies involved. It includes manufacturers, distributors, research & product developers, and end users. The ecosystem of the overall Pharmaceutical drying equipment market comprises the different elements and subdivisions present in it. Manufacturers include the organizations involved in research, product development, optimization, and launch. Distributors include third parties and eCommerce sites linked with organizations for marketing freeze dryers, spray dryers, fluid bed dryers, and vacuum dryers. Research and product development includes in-house research facilities organizations, contract research organizations, and contract development and manufacturing organizations, which play a crucial role in outsourcing research for product development to manufacturers.

Recent Developments of Pharmaceutical Drying Equipment Market:

- Expansion: On June 7, 2024, Syntegon expanded its pharmaceutical processing and packaging business by acquiring Azbil Telstar, previously a subsidiary of Japan’s Azbil Corporation.

- Rebrand: In February 2023, SP Industries, Inc. (“Scientific Products”), a leading global provider of fill-finish drug manufacturing solutions, lyophilizers, and laboratory equipment and supplies, rebranded and began operating under the name ATS Life Sciences Scientific Products.

- Investment: In September 2022, GEA invested EUR 70 million to build a new pharmaceutical technology center for freeze dryers in Elsdorf, North Rhine-Westphalia, Germany.

- Agreement: In November 2021, ATS Automation Tooling Systems Inc., a leading automation solutions provider, announced that it had signed a definitive agreement to acquire SP Industries, Inc. for USD 445 million.

Content Source: