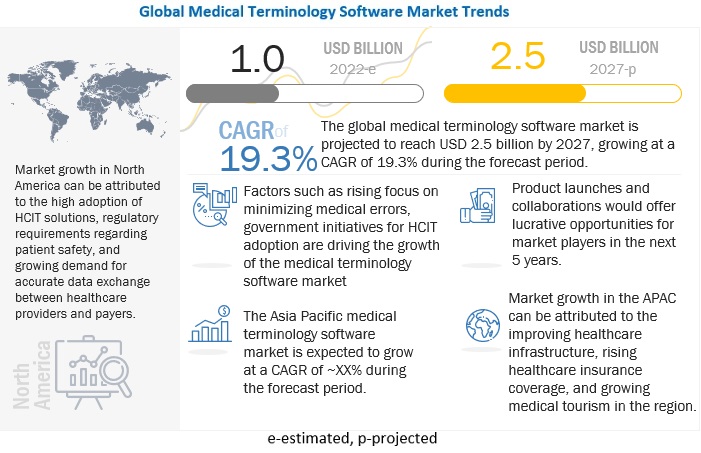

According to market research report, “Medical Terminology Software Market by Application (Data Aggregation, Reimbursement, Data Integration, Clinical Trials), Products & Services (Services, Platforms), End User (Healthcare Providers, Healthcare Payers, IT Vendors) – Global Forecast to 2027″, is projected to reach USD 2.5 billion by 2027 from an estimated USD 1.0 billion in 2022, at a CAGR of 19.3% during the forecast period.

Growth in this market is driven by the using consistent, standardized clinical terminology to help medical practitioners access and understand clinical data found in healthcare applications, government initiatives to adopt HCIT solutions, and fragmentation in terms of medical content & infrastructure. However, high cost of infrastructure & maintenance in developing countries are expected to restrain market growth to a certain extent.

Currently, healthcare ecosystems are quite fragmented in terms of content and infrastructure. A health delivery organization may manage 40 or more separate IT systems, with each system having its own clinical terminology content and infrastructure. These terminology silos make it difficult for organizations to leverage isolated clinical data, which impacts downstream activities such as data analytics.

The problem further intensifies when a health system seeks to share data with other healthcare partners. In that scenario, the relevant data resides in numerous isolated systems scattered across multiple healthcare organizations. The lack of a common clinical vocabulary across a magnitude of standalone systems is a key obstacle to national efforts to increase interoperability, transparency, and collaboration within the healthcare system.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=239939409

The quality reporting segment is expected to witness the highest growth rate in the medical terminology software market, by application

Based on application, the quality reporting segment is expected to register the highest CAGR during the forecast period. Factors responsible for the growth of this segment are the benefits offered by the segment such as improved patient safety, improvements in the quality of care, efficient healthcare services & patient outcomes.

Browse in-depth TOC on “Medical Terminology Software Market”

74 – Tables

26 – Figures

124 – Pages

By end user, the private payers segment accounted for the largest share of the medical terminology software market, by healthcare payers in 2021.

The private payers segment is estimated to have the largest share by healthcare payers end user of the market. The large share of the segment is attributed to the advantages offered to the private payers such as benefits of normalization through fully integrated medical terminology management solutions to ensure more effective communication, less inconsistency, and more streamlined administrative costs.

Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=239939409

North America dominated the medical terminology software market in 2021

North America accounted for the largest share of the medical terminology software market in 2021, followed by Europe and Asia Pacific. The large share of North America in the global market can be attributed to the presence of a strong IT infrastructure in the region, the high adoption rate of HCIT technologies, regulatory requirements regarding patient safety, and the growing demand for accurate data exchanges between healthcare providers & payers to streamline workflows. The presence of major market players in the US and a large number of outpatient healthcare facilities are further contributing to the growth of the market in the region.

Wolters Kluwer N.V. (Netherlands), 3M (US), Intelligent Medical Objects, Inc. (US), Apelon, Inc. (US), Clinical Architecture, LLC (US), CareCom (Denmark), BiTAC (Spain), B2i Healthcare (Hungary), BT Clinical Computing (Belgium), and HiveWorx (Ireland) are the major players in this market. These companies are majorly focusing on the strategies such as agreements, collaborations, partnerships, and service launches in order to remain competitive and further increase their share in the market.