The key drivers for the waste management market include stringent regulations of governments worldwide for better management of waste and initiate environmental protection; strong focus of several governments to conduct awareness programs showcasing importance of waste segregation and waste management; technological advances and shortened life cycle of electronic products help in increasing e-waste.

The global waste management market size is projected to reach USD 542.7 billion by 2026 from an estimated value of USD 423.4 billion in 2021, at a CAGR of 5.1%.

The key players in the waste management market include companies such as Waste Management (US), Veolia (France), Republic Services (US), SUEZ (France), and Waste Connections (US). Major strategies adopted by the players are product launches, contracts, agreements, collaborations, partnerships, and mergers & acquisitions, from January 2018 to June 2021. Contracts was the most commonly adopted strategy.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=72285482

This research report categorizes the waste management market based on Waste Type, Service Type, End User, and Region.

Based on the waste type:

- Hazardous Waste

- E-waste

- Plastic Waste

- Bio-medical Waste

- Others

Based on the service type:

- Open Dumping

- Incineration/Combustion

- Landfill

- Recycling

- Composting & Anaerobic Digestion

Based on the end user:

- Residential

- Commercial

- Industrial

Based on the region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

By service type, the landfill segment is expected to be the largest contributor during the forecast period.

The landfill held the largest share of the waste management market, by waste type in 2020. The growth of the landfill segment is driven by the Increased Need to dispose of waste that cannot be recycled. Landfills offer various advantages, such as it offers good energy sources; it is an eco-friendly option; it keeps cities, towns, and districts clean, and helps keep hazardous waste segregated; it is a relatively cheaper option for waste management. The market for the landfill segment in Asia Pacific is expected to grow at the 7.2% CAGR during the forecast period.

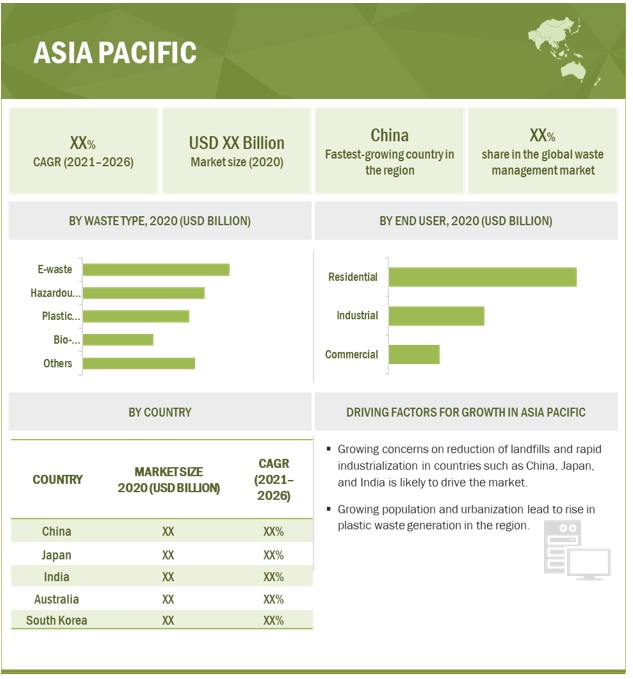

Asia Pacific is expected to be the largest and fastest-growing market during the forecast period.

Asia Pacific accounted for the largest share of the global waste management market in 2020. The region has been segmented, by country, into China, Japan, India, Australia, South Korea, and Rest of Asia Pacific. Rest of Asia Pacific mainly includes Singapore, Malaysia, Thailand, and Indonesia. The population growth in the region, the high disposable income of the people, and the increased demand for packaged food products are among a few major factors that drive the growth of waste management in the region. Asia Pacific is also a key contributor to marine plastic pollution. The materials involved include plastic bottles, plastic bags, single-use plastic items, and plastic packaging, among others. Key countries responsible for this kind of pollution include China, Indonesia, and Thailand.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=72285482

Report Objectives:

- To define, describe, waste management market, based on waste type, service type, and end user

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, the Middle East, & Africa)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as new product launches, contracts, agreements, investments & expansions, and mergers & acquisitions, in the waste management market