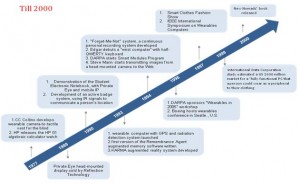

The development of wearable devices that we are seeing today has undergone series of miniaturization from discrete electronics over hybrid designs to fully integrated designs, where a single processor chip, a battery, and some interface conditioning comprise the entire unit. The period from 1970 onwards witnessed huge research interests in wearable computer and they made the device more compact and easy to wear; at the same time performing daily computing need of the user. The timeline below depicts the major developments in the wearable device technology and industry until 2000.

Figure 1: Evolution of Wearable Electronics – till year 2000

A host of Wearable Electronics Market (Smart Textiles) products began to arrive in the market from 2007, ranging from goggles to wrist watch to smart textiles. Industry experts believe that the technology’s next big innovation is organic and intimate use of computing devices that can be easily worn by the user. This is indeed very much visible as consumer electronic and textile technology giants are preparing launch of products such as Google’s Smart glass; Apple’s rumored iWatch and various types of tech-embedded clothing in 2013 and 2014.

Undoubtedly, the wearable technology trend is gaining momentum and market will witness increasingly large number of new products in the coming time. The success of the market and hence the question of attaining economy of scale hinges on the successful of these new products hitting the market. The global wearable electronics market was worth more than $2.5 billion in revenue in 2012 and is expected to cross $8 billion in 2018, growing at a healthy CAGR of 17.7% from 2013 to 2018. The global wearable technology ecosystem’s value was estimated to more than $4 billion as of 2012, and is expected to reach cross $14 billion by 2018, growing at a CAGR more than 18% from 2013 to 2018.

The total addressable market (TAM) for wearable technology is estimated to be more than $14 billion, as of 2012, and the current level of penetration for wearable technology was estimated to be roughly 18%. This market penetration rate of wearable technology is expected to accelerate (increasing rate of penetration every year) over the next five years, reaching roughly 46% penetration level in the TAM, by 2018.

The market’s key player pool which is likely to remain fragmented would experience a consolidation, as big players go on acquiring promising small companies. Key success factor in acquisitions for tech industry giants is the ability to innovate. However, a disruptive innovation for the wearable electronics would be in the field of battery, power supply and energy storage. With the convergence of computing facilities into a ubiquitous system, the major roadblock continues to be the battery system that could possibly meet the high power & energy requirement.

However, in recent past there have been some promising developments developing proprietary batteries for wearable technology, including mobile accessories, compact wireless devices, health and fitness monitoring, and medical devices. Upcoming battery technologies for wearable electronics remove longstanding limitations on the rechargeability of zinc-based batteries and offers significant volumetric energy density, form factor, safety, cost, and processing advantages versus other rechargeable battery chemistries.

Efforts are being made all across the globe to harness energy with a vision to make wearable electronics self sufficient in terms of energy requirement. Thanks to the advancement in material technology, it is expected that self-powered, self-charging wearable electronic clothing such as e-textiles will hit the market by 2016. The commercialization of e-textile will open many avenues for exploring energy harvesting and integrating electronics in the textile, right at the production of fabrics. In all perspective, it is expected that the market for wearable electronics will grow at a staggering rate both in terms of volume and revenue in coming year.

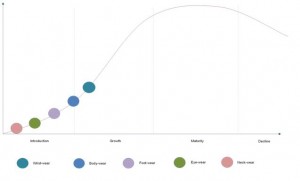

The industry is yet to witness the rise of its biggest revolutionary products, from a pool of several attractive new innovations. Going by recent developments, it can be expected that wearable electronic smart glasses and smart wrist-watch computers would draw more competition and are likely to become the image of the industry. In terms of products, wrist-wear accounted for the largest market revenue in 2012, with total revenue of the most established wearable electronic products – wrist-watches and wrist-bands combined, crossing $850 million. The figure below shows the current stages of various product categories in wearable electronics, in the market’s life cycle.

Figure 2: Product Markets in 2013 – Wearable Electronics Market Life Cycle

Source: MarketsandMarkets Analysis

The evolution in the wearable ecosystem will spurt a growth in the semiconductor industry backed by increased shipment and revenue and technological advancement, especially miniaturization of chips and chipsets. The market of electrical and electronic components for wearable electronic products is also expanding rapidly, as the market value of components amounts to roughly 66% of that of products. With dynamically changing landscape for components in wearable electronics, the global wearable electronic components market is expected to cross $6 billion by 2018, offering huge revenue potential for key electronic component manufacturers focusing on this field.

The competitive landscape of the market presents a very interesting picture, where large number of small players has become a force to reckon with. The market is witnessing a series of new product launch and announcement and partnership across the value chain. Some big announcements by small and big players alike are expected in the coming months.

Some of the key players in the wearable electronics market include Adidas AG (Germany), Fitbit, Inc. (U.S.), Fibretronic Ltd. (U.K.), Google, Inc. (U.S.), Jawbone, Inc. (U.S.), Nike, Inc. (U.S.), Olympus Corporation (U.S.), Recon Instruments, Inc. (Canada), Vuzix Corporation (U.S.), and Weartech s.l (Spain) among others. Whatever be the outcome of this intense competition, one likely winner is going to be the consumer who would have a variety of advanced wearable electronic gadgets that can integrate sophisticated computing, communication and networking technologies into one’s daily life.

Contact:

Mr. Rohan

North – Dominion Plaza,

17304 Preston Road,

Suite 800, Dallas, TX 75252

Tel: +1-888-6006-441

Email: sales@marketsandmarkets.com

![]()

![]()

![]()

![]()

![]()